2025 WSDM Fiyat Tahmini: Makine öğrenimi kullanılarak Web Arama ve Veri Madenciliği Konferansı maliyetlerinin tahmin edilmesi

Giriş: WSDM'nin Piyasadaki Konumu ve Yatırım Değeri

Wisdomise AI (WSDM), yapay zeka destekli bir bilgi ve yatırım platformu olarak kuruluşundan bu yana servet yaratımını demokratikleştirmeye odaklanmıştır. 2025 itibarıyla WSDM'nin piyasa değeri 338.436 $, dolaşımdaki arzı yaklaşık 487.871.512 token ve fiyatı 0,0006937 $ civarındadır. "Servet yaratımını demokratikleştirme" vizyonuyla bilinen bu varlık, yapay zeka tabanlı yatırım ve finansal kapsayıcılık alanında giderek daha belirleyici bir rol üstlenmektedir.

Bu makale, WSDM'nin 2025-2030 dönemindeki fiyat hareketlerini; geçmiş trendler, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik ortamı göz önünde bulundurarak kapsamlı biçimde analiz edecek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. WSDM Fiyat Geçmişi ve Güncel Piyasa Durumu

WSDM Tarihsel Fiyat Seyri

- 2024: İlk çıkış, fiyat 14 Mayıs'ta 0,16 $ ile zirve yaptı

- 2025: Büyük piyasa düşüşü, fiyat 29 Ekim'de 0,0006331 $ ile tüm zamanların en düşük seviyesini gördü

WSDM Güncel Piyasa Durumu

WSDM şu anda 0,0006937 $ seviyesinde işlem görüyor ve yakın dönemdeki dip seviyesinden hafif bir toparlanma sergiliyor. Token son bir yıl içinde %93,11 oranında değer kaybetti ve bu, uzun süreli bir düşüş trendini gösteriyor. Son 24 saatte %0,53'lük küçük bir düşüş, son saatte ise %0,74'lük ılımlı bir artış yaşandı. Piyasa değeri 338.436 $, tam seyreltilmiş değerlemesi ise 693.700 $. Son 24 saatte işlem hacmi 115.706 $ ve bu rakam düşük likiditeye işaret ediyor. Mevcut fiyat, 2024'teki lansmandan kısa süre sonra görülen 0,16 $'lık zirvenin oldukça altında bulunuyor.

Mevcut WSDM piyasa fiyatını görmek için tıklayın

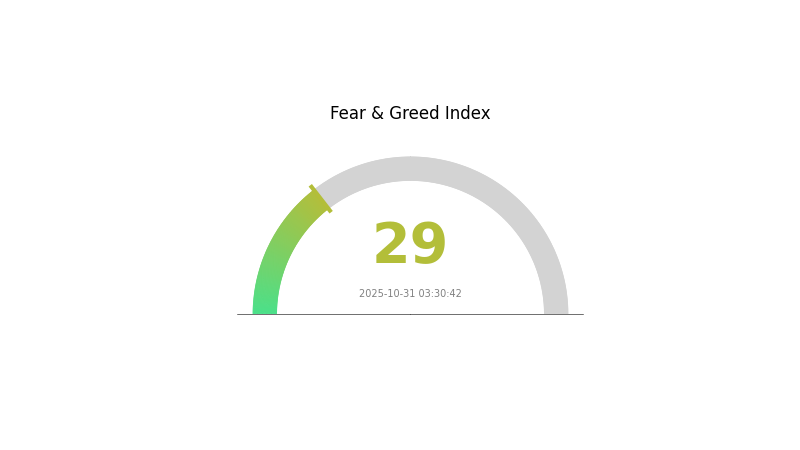

WSDM Piyasa Duyarlılığı Endeksi

2025-10-31 Korku ve Açgözlülük Endeksi: 29 (Korku)

Mevcut Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasası şu anda korku seviyesinde ve Korku & Açgözlülük Endeksi 29 değerini gösteriyor. Bu, yatırımcılar arasında temkinli bir ortam oluştuğuna işaret ediyor ve uzun vadeli bakış açısına sahip olanlar için alım fırsatları sunabilir. Ancak karar verirken kapsamlı araştırma yapmak ve temkinli olmak çok önemlidir. Piyasa duyarlılığı hızla değişebilir; korku genellikle düşük değerlemeye işaret etse de, yatırım kararlarında çok yönlü değerlendirme yapmak gereklidir.

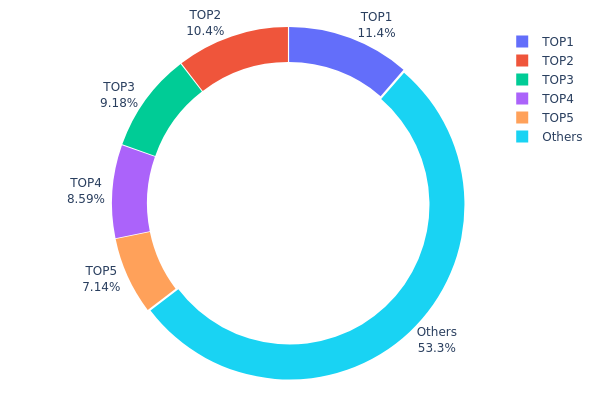

WSDM Varlık Dağılımı

Adres varlık dağılımı verileri, WSDM tokenlarının yoğunlaşma düzeyi hakkında kritik bilgiler sunar. En büyük beş adres, toplam arzın %46,67'sini elinde bulunduruyor ve en büyük adresin payı %11,35. Bu konsantrasyon oranı, nispeten merkezi bir dağılıma işaret ediyor ve piyasa dinamiklerini etkileyebilir.

Tek bir adreste aşırı yoğunluk olmasa da, üst sıralardaki adreslerin büyük varlıkları fiyat hareketi ve likiditeyi etkileyebilir. Kalan %53,33'lük kısım diğer adreslere dağıtılmış olsa da, piyasa yapısı yine de büyük sahiplerin hamlelerine hassas kalabilir. Bu dağılım, sınırlı bir merkeziyetsizlik gösteriyor ve piyasa istikrarı ile büyük sahiplerin koordineli hareketlerine karşı duyarlılığı artırıyor.

Mevcut WSDM Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xf91b...ab798d | 113.541,67K | 11,35% |

| 2 | 0xfa1b...97e250 | 104.265,54K | 10,42% |

| 3 | 0x59a7...ce79e2 | 91.750,00K | 9,17% |

| 4 | 0x51e3...bc75e0 | 85.942,38K | 8,59% |

| 5 | 0x24e0...3f63d0 | 71.400,00K | 7,14% |

| - | Diğerleri | 533.100,42K | 53,33% |

II. WSDM'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Talebi: Wisdomise AI (WSDM) fiyatı, özellikle yatırımcıların platformun gelişim potansiyeline dair iyimser beklentileriyle artan piyasa talebinden doğrudan etkileniyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Düzenleyici Durum: WSDM'nin düzenleyici statüsü, yatırımcıların işlem kararlarını etkileyerek fiyat üzerinde etkili olabilir.

Makroekonomik Ortam

- Yatırımcı Duyarlılığı: Yatırımcıların WSDM'ye ve potansiyeline yönelik genel algısı, fiyat hareketlerinde belirleyici rol oynar.

Teknolojik Gelişim ve Ekosistem İnşası

- Yapay Zeka Platformu Gelişimi: Wisdomise AI'nin yatırım platformunun geliştirilmesi ve iyileştirilmesi, fiyat artışının temel itici gücüdür.

III. 2025-2030 Dönemi İçin WSDM Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00063 $ - 0,00069 $

- Tarafsız tahmin: 0,00069 $ - 0,00076 $

- İyimser tahmin: 0,00076 $ - 0,00084 $ (pozitif piyasa duyarlılığı gerektirir)

2027-2028 Görünümü

- Piyasa evresi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00077 $ - 0,00122 $

- 2028: 0,00066 $ - 0,00117 $

- Temel katalizörler: Benimsenmede artış ve piyasa genişlemesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00110 $ - 0,00126 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00126 $ - 0,00142 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,00142 $ - 0,00163 $ (olağanüstü piyasa koşulları ve yaygın benimseme varsayımıyla)

- 2030-12-31: WSDM 0,00163 $ (olası zirve fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,00084 | 0,00069 | 0,00063 | 0 |

| 2026 | 0,00093 | 0,00076 | 0,00071 | 10 |

| 2027 | 0,00122 | 0,00085 | 0,00077 | 22 |

| 2028 | 0,00117 | 0,00104 | 0,00066 | 49 |

| 2029 | 0,00142 | 0,0011 | 0,00072 | 58 |

| 2030 | 0,00163 | 0,00126 | 0,00101 | 82 |

IV. WSDM için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

WSDM Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Risk toleransı yüksek, uzun vadeli bakış açısına sahip yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde WSDM token biriktirin

- Yönetim ve ödül fırsatları için tokenlerinizi stake edin

- Tokenleri güvenli, saklama dışı bir cüzdanda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirleyin

- RSI: Aşırı alım/aşırı satım koşullarını takip edin

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Teknik göstergelere göre net giriş-çıkış noktası belirleyin

- Risk için zarar durdur emri kullanın

WSDM Risk Yönetimi Çerçevesi

(1) Varlık Dağıtım Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara dağıtın

- Stablecoin kullanımı: Yüksek volatilite dönemlerinde WSDM'nin bir kısmını stablecoin'e çevirin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutmak için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı doğrulama aktif edin, güçlü şifreler kullanın ve yazılımı güncel tutun

V. WSDM için Potansiyel Riskler ve Zorluklar

WSDM Piyasa Riskleri

- Yüksek volatilite: WSDM fiyatı ciddi dalgalanmalara uğrayabilir

- Düşük likidite: Yetersiz işlem hacmi alım-satımı zorlaştırabilir

- Rekabet: Diğer yapay zeka tabanlı yatırım platformları pazar payı alabilir

WSDM Düzenleyici Riskler

- Düzenleyici belirsizlik: Değişen kripto para düzenlemeleri WSDM'nin faaliyetlerini etkileyebilir

- Uyum zorlukları: Farklı ülkelerde değişen düzenleyici gerekliliklere uyum

- Olası kısıtlamalar: Devlet müdahaleleri WSDM'nin işlevselliğini veya erişimini sınırlandırabilir

WSDM Teknik Riskleri

- Akıllı sözleşme açıkları: Temel kodda güvenlik açığı veya hata riski

- Ölçeklenebilirlik sorunları: Platformun artan kullanıcı talebini karşılamakta zorlanması

- Yapay zekaya bağımlılık: Performans, AI modellerinin doğruluğu ve etkinliğine bağlıdır

VI. Sonuç ve Eylem Önerileri

WSDM Yatırım Değeri Değerlendirmesi

WSDM, yapay zeka tabanlı yatırım alanında özgün bir değer sunuyor ve uzun vadede büyüme potansiyeli taşıyor. Ancak kısa vadede piyasa dalgalanması ve düzenleyici belirsizlikler nedeniyle önemli risklerle karşı karşıya.

WSDM Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve projeyi öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Kripto portföyünüzün orta bir kısmını WSDM'ye ayırmayı değerlendirin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve WSDM'yi çeşitlendirilmiş bir kripto stratejisinin parçası olarak değerlendirin

WSDM Katılım Yolları

- Borsa işlemleri: Gate.com üzerinden WSDM token satın alın

- Stake etme: Tokenleri stake ederek yönetime katılın ve ödül kazanın

- Platform hizmetlerini kullanma: Wisdomise'ın yapay zeka destekli yatırım araçlarından faydalanın

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcılar kendi risk toleranslarına göre hareket etmeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Hamster Kombat coin 1 $'a ulaşır mı?

Mevcut trendlere göre, Hamster Kombat (HMSTR) 2028'e kadar blockchain oyunlarının büyümesi ve piyasa gelişmeleriyle 1 $'a ulaşabilir.

Solana 2025'te 1.000 $'a ulaşır mı?

Mevcut piyasa trendleri ve Solana'nın büyüme potansiyeli göz önüne alındığında, 2025'te 1.000 $'a ulaşması mümkün ancak garanti değildir. Benimsenme, teknolojik ilerlemeler ve genel kripto piyasası koşulları Solana'nın gelecekteki fiyatını belirleyecektir.

Dash yeniden 1.000 $'ı görür mü?

Mevcut piyasa trendlerine göre, Dash'in yakın vadede tekrar 1.000 $'a çıkması düşük olasılıktadır. Ancak kripto piyasaları oldukça öngörülemez olduğundan, ani fiyat sıçramaları her zaman mümkündür.

WIF coin toparlanır mı?

Piyasa analizine göre, kripto piyasasında yükseliş hareketi yeniden başlarsa WIF yaklaşık 1,5 $ seviyesine toparlanabilir.

2025 SKYAI Fiyat Tahmini: Yükselen Yapay Zekâ Teknolojisi İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 KITEAI Fiyat Tahmini: Yapay Zeka Destekli Kripto Varlıkta Zirveye Yolculuk mu, Yoksa Piyasa Dalgalanması mı?

Sahara AI (SAHARA) Fiyat Analizi: Son Volatilite Eğilimleri ve Piyasa Korelasyonları

kripto neden çöküyor ve toparlanacak mı?

2025 SPX Fiyat Tahmini: S&P 500’ü Yeni Zirvelere Taşıyabilecek Temel Faktörler

2025 HOLO Fiyat Tahmini: Halving Sonrası Kripto Piyasasında Trendler ve Büyüme Potansiyeli Analizi

Kripto Para Borsası Klon Scripti Fiyatlandırmasıyla İlgili En Sık Sorulan Sorular | Sektör Uzmanlarının Değerlendirmeleri