2025 W Fiyat Tahmini: Küresel W Endeksinin Piyasa Eğilimleri ve Gelecekteki Değerlemesinin Analizi

Giriş: W'nin Piyasadaki Yeri ve Yatırım Potansiyeli

Wormhole (W), zincirler arası birlikte çalışabilirlik sağlayan protokol olarak blokzincir ekosisteminde öncü bir konum edindi. 2025 yılı itibarıyla Wormhole’un piyasa değeri 537.544.363 dolar; dolaşımdaki arz ise yaklaşık 4.766.309.305 token ve fiyatı 0,11278 dolar civarındadır. “Blokzincirler arasında köprü” niteliğiyle bu varlık, farklı ağlar arasında sorunsuz iletişim ve varlık transferini desteklemede giderek kritik bir rol üstleniyor.

Bu makale, Wormhole’un 2025-2030 yılları arasındaki fiyat gelişimini kapsamlı şekilde analiz ederek, geçmiş trendler, piyasa arz-talep dengesi, ekosistem büyümesi ve makroekonomik dinamikler ışığında profesyonel fiyat öngörüleri ile yatırımcılar için uygulanabilir stratejiler sunacaktır.

I. W Fiyat Geçmişi ve Mevcut Piyasa Durumu

W Fiyat Geçmişinin Seyri

- 2024: W, 3 Nisan 2024’te 1,79 dolar ile tüm zamanların zirvesine ulaşarak proje için önemli bir eşik oluşturdu.

- 2025: Piyasanın gerilemesiyle W, 22 Haziran 2025’te 0,05113 dolar ile dip seviyeyi gördü.

W Mevcut Piyasa Durumu

19 Eylül 2025 tarihinde W, 0,11278 dolardan işlem görüyor ve son 24 saatte %2,73 artış sergiledi. Son bir ayda %45,57 yükselen token, geçen yılın aynı dönemine göre hala %46,43 aşağıda.

W'nin piyasa değeri şu an 537.544.363 dolar; kripto para sıralamasında 162. sırada bulunuyor. Dolaşımdaki arz 4.766.309.305 adet ve bu miktar toplam 10 milyar tokenin %47,66’sına denk geliyor.

24 saatlik işlem hacmi 29.341.535 dolar seviyesinde; bu, orta seviye işlem hareketliliğini gösteriyor. Fiyatı son dip seviyenin üzerinde olsa da zirveye oldukça uzak, bu da hem büyüme hem dalgalanma ihtimalinin sürdüğünü gösteriyor.

W Piyasa Duyarlılığı

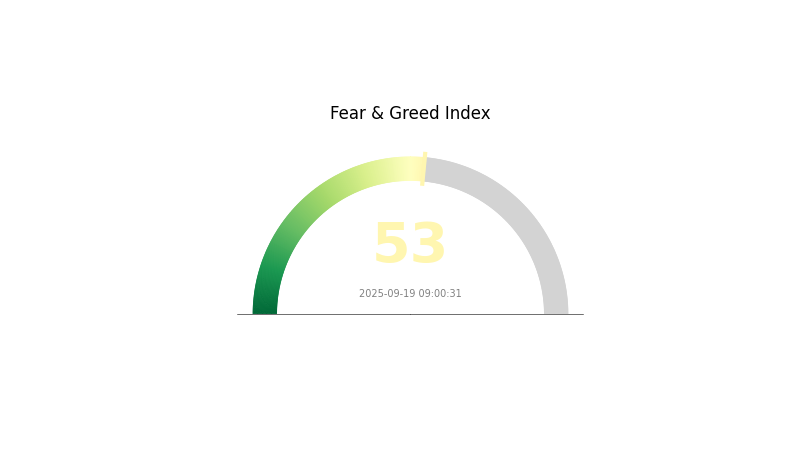

19 Eylül 2025 Korku ve Açgözlülük Endeksi: 53 (Nötr)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında bugün duyarlılık dengede: Endeksin 53’e ulaşması, yatırımcıların ne aşırı iyimser ne de kötümser olduğuna işaret ediyor. Nötr tablo, temkinli yatırımcılar için stratejilerini gözden geçirme ve bilinçli karar alma fırsatı sunar. Piyasa duygusu aşırıya kaçmasa da, olası dalgalanmalara karşı dikkatli olmak ve yatırım algısında meydana gelebilecek ani değişimleri izlemek gerekir.

W Varlık Dağılımı

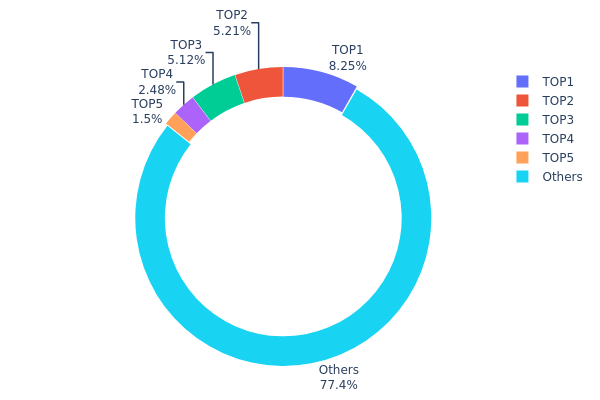

Adres varlık dağılımı grafiği, W tokenlerinin cüzdanlar arasında nasıl paylaşıldığını gösteriyor. En büyük 5 adres toplam arzın %22,54’ünü tutuyor. En büyük sahip %8,25 ile önde; diğer iki adresin ise %5’in üzerinde payı bulunuyor.

Bu yoğunluk belirgin olsa da aşırı merkezileşme anlamına gelmiyor. Tokenlerin %77,46’sı birçok adrese yayılmış durumda; bu da sahiplikte çeşitliliği gösteriyor. Büyük sahiplerin varlığı piyasa dinamiklerini etkileyebilir; zira büyük işlemler fiyat ve likidite üzerinde etki oluşturabilir.

Dağılım, merkezi ve merkeziyetsiz sahiplik arasında bir denge sunuyor. Üst sahipler kayda değer paylara sahip olsa da genel yayılım piyasa istikrarına destek olup tek taraflı manipülasyon riskini azaltıyor. Bu yapı, W ekosisteminin olgunlaşmaya başladığını ve hem büyük yatırımcıların hem de geniş bir küçük yatırımcı tabanının varlığını işaret ediyor.

W'nin güncel varlık dağılımını görüntüleyin

| En Büyükler | Adres | Adet | Pay (%) |

|---|---|---|---|

| 1 | 7S7r1m...HPoznq | 825.243,07K | 8,25% |

| 2 | 9WzDXw...YtAWWM | 520.974,36K | 5,20% |

| 3 | E24GhY...nX2Dw3 | 511.733,07K | 5,11% |

| 4 | 8nDFPa...SwzdRN | 248.146,47K | 2,48% |

| 5 | Dpfz8B...DLugvo | 150.000,00K | 1,50% |

| - | Diğerleri | 7.743.885,41K | 77,46% |

II. W'nin Gelecek Fiyatını Belirleyen Temel Unsurlar

Arz Mekanizması

- Maksimum Arz: 10 milyar W token

- Tarihsel Model: W 2020’de piyasaya sürüldüğünden veri geçmişi sınırlı

- Aktif Durum: Dolaşımdaki arz 4,77 milyar W; arz artışı fiyatı etkileyebilir

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Yatırımcılar: Coinbase Ventures ve Jump Crypto önde gelen yatırımcılar

- Kurumsal Kullanım: Wormhole zincirler arası birlikte çalışabilirlik için pek çok projede kullanılmakta

- Devlet Politikaları: Düzenleyici gelişmeler protokol benimsenmesini etkileyebilir

Makroekonomik Çevre

- Para Politikası Etkisi: Merkez Bankası politikaları kripto duyarlılığına yön veriyor

- Enflasyon Korumalı Özellikler: W'nin enflasyon karşıtı rolü henüz netleşmedi

- Jeopolitik Etmenler: Küresel ekonomik gelişmeler kripto eğilimlerini etkiler

Teknoloji ve Ekosistem Gelişimi

- Zincirler Arası Birlikte Çalışabilirlik: Wormhole, farklı blokzincirlerde varlık transferini kolaylaştıran teknoloji sunuyor

- Ekosistem Genişlemesi: Ethereum, Solana, Arbitrum, Optimism ve Base gibi ağlarla entegrasyon

- DApp Ekosistemi: Zincirler arası işlevi için Wormhole’u kullanan merkeziyetsiz uygulama sayısı artıyor

III. 2025-2030 W Fiyat Tahmini

2025 Beklentisi

- İhtiyatlı tahmin: 0,05867 - 0,11283 dolar

- Nötr tahmin: 0,11283 - 0,13000 dolar

- İyimser tahmin: 0,13000 - 0,14217 dolar (güçlü piyasa ve olumlu proje haberleriyle)

2027-2028 Beklentisi

- Piyasa: Benimsemenin hızlandığı büyüme dönemi muhtemel

- Fiyat aralığı tahmini:

- 2027: 0,08612 - 0,17526 dolar

- 2028: 0,12891 - 0,22518 dolar

- Kritik tetikleyiciler: Teknolojik ilerleme, yaygın kripto benimsemesi, destekleyici regülasyon

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,19417 - 0,22039 dolar (istikrarlı piyasa ve sürekli proje gelişimi ile)

- İyimser senaryo: 0,22039 - 0,28000 dolar (güçlü piyasa ve çarpıcı proje başarıları ile)

- Dönüştürücü senaryo: 0,28000 - 0,32838 dolar (çığır açan yenilikler ve ana akım benimseme ile)

- 31 Aralık 2030: W 0,32838 dolar (iyimser öngörüye göre olası zirve)

| Yıl | Öngörülen Maksimum Fiyat | Öngörülen Ortalama Fiyat | Öngörülen Minimum Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,14217 | 0,11283 | 0,05867 | 0 |

| 2026 | 0,17467 | 0,1275 | 0,12367 | 13 |

| 2027 | 0,17526 | 0,15109 | 0,08612 | 33 |

| 2028 | 0,22518 | 0,16317 | 0,12891 | 44 |

| 2029 | 0,2466 | 0,19417 | 0,17087 | 72 |

| 2030 | 0,32838 | 0,22039 | 0,13444 | 95 |

IV. W için Yatırım Stratejileri ve Risk Yönetimi

W Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip, uzun vadeli bakış açısı olanlar

- Uygulama önerileri:

- Ortalama maliyet yöntemiyle zaman içinde W biriktirilmesi

- Kısmi kar almak için fiyat hedefleri belirleme

- Tokenlerin özel anahtarı yatırımcıda olan bir cüzdanda saklanması

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli ortalama: Eğilimleri ve olası dönüş noktalarını belirleme

- RSI: Aşırı alım/aşırı satım durumlarını saptama

- Vade arası işlemler için:

- Wormhole ekosistemine dair piyasadaki gelişmeleri izlemek

- Riske karşı stop-loss emirleriyle önlem almak

W Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- İhtiyatlı yatırımcılar: Portföyün %1-3’ü

- Orta seviye yatırımcılar: Portföyün %3-5’i

- Agresif yatırımcılar: Portföyün %5-10’u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı blokzincir projelerine yayılım

- Opsiyon stratejileri: Oynaklığa karşı koruma için opsiyonları değerlendirme

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdan önerisi: Gate Web3 Cüzdan

- Alternatif yazılım cüzdanı: Resmi Wormhole cüzdanı (uygunsa)

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifreler ve güncel yazılım kullanımı

V. W için Riskler ve Zorluklar

W Piyasa Riskleri

- Yüksek volatilite: W token fiyatında sert dalgalanmalar görülebilir

- Rekabet baskısı: Diğer çözümler Wormhole’un payını azaltabilir

- Likidite riski: Büyük işlemlerde fiyat dengesizliği ihtimali

W Düzenleyici Riskler

- Değişken regülasyonlar: W'nin kullanım ve işlemine dair net olmayan yasal çerçeve

- Sınır ötesi uyumluluk: Farklı ülke ve bölgelerde mevzuata tam uyum gerekliliği

- Menkul kıymet sınıflandırılması riski: W'nin menkul kıymet statüsüne girmesi halinde yasal yaptırım tehlikesi

W Teknik Riskler

- Akıllı sözleşme açıkları: Kod tabanında istismar edilebilecek boşluklar

- Ağ tıkanıklığı: Ölçeklendirme sorunları nedeniyle yavaş ve pahalı işlemler

- Birlikte çalışabilirlik sorunları: Farklı ağlar arasında entegrasyon riskleri

VI. Sonuç ve Uygulama Önerileri

W’nin Yatırım Potansiyelinin Değerlendirilmesi

W token, zincirler arası birlikte çalışabilirlik alanında yüksek riskli fakat yüksek getiri potansiyeli olan bir varlık olarak öne çıkıyor. Uzun vadede kayda değer bir fırsat sunmakla birlikte, kısa vadeli oynaklık ve teknik riskler titizlikle incelenmeli.

W Yatırım Tavsiyeleri

✅ Yeni yatırımcılar: Küçük alımlarla başlayıp zincirler arası teknolojiye odaklanmalı

✅ Deneyimli yatırımcılar: Dengeli bir portföy kapsamında orta ölçekli yatırım düşünebilir

✅ Kurumsal yatırımcılar: Kapsamlı analizle W’yi blokzincir altyapı yatırımlarında değerlendirmeli

W Alım-Satım Seçenekleri

- Spot işlem: Gate.com üzerinden W satın alın

- Staking: Wormhole platformunda sunuluyorsa staking fırsatlarını değerlendirin

- DeFi entegrasyonu: W kullanarak merkeziyetsiz finans olanaklarını keşfedin

Kripto para yatırımları son derece yüksek risk taşır; bu içerik yatırım tavsiyesi değildir. Her yatırımcı, kendi risk iştahına göre hareket etmeli ve finansal danışmanına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

W coin için 2025 fiyat öngörüsü nedir?

Teknik analize göre W coin’in 2025’te 0,000015 dolara ulaşması bekleniyor. Uzun vadeli öngörüye göre token için büyüme potansiyeli mevcut.

2025'te WIF coin ne kadar yükselebilir?

Piyasa projeksiyonları, WIF coin’in 2025 yılında 2,22 dolara ulaşabileceğini gösteriyor.

Wormhole kripto paranın geleceği var mı?

Evet, Wormhole kripto para birimi umut vaat ediyor. Birlikte çalışabilirliğe ve yeni entegrasyonlara odaklanması, çapraz zincir segmentinde büyüme potansiyeli sağlıyor.

Wink coin 1 cent’e ulaşabilir mi?

Mevcut performansa göre Wink coin’in 0,01 dolara ulaşması beklenmiyor; öngörüler bu hedefe erişilemeyeceğini gösteriyor.

Avalanche (AVAX) 2025 Fiyat Analizi ve Piyasa Trendleri

FTT Açıklaması

2025 PYTH Fiyat Tahmini: Oracle Network Token’ın Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 VELO Fiyat Tahmini: Piyasa Trendleri ve Bir Sonraki Boğa Koşusuna Yönelik Potansiyel Büyüme Faktörlerinin Analizi

2025 YFI Fiyat Tahmini: Yearn Finance Token’ı için Olası Büyüme Dinamikleri ve Piyasa Analizi

2025 BIO Fiyat Tahmini: Biyoplastik Sektörü İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Zcash (ZEC), Monero (XMR) ve Dash (DASH) gizlilik odaklı kripto para piyasasında nasıl konumlanıyor?

Solana’nın geçmişinde yaşanan önemli güvenlik açıkları ve siber saldırılar nelerdir, bunlar SOL yatırımcıları üzerinde nasıl bir etki yaratır?

Solana'nın 2025 yılında piyasa değeri sıralaması ile 24 saatlik işlem hacmi nedir?

XL1 ve GRT: İki Önde Gelen Blockchain Oracle Çözümünün Detaylı Karşılaştırması

PROPS vs UNI: İki Önde Gelen DeFi Yönetim Token'ının Kapsamlı Karşılaştırılması