2025 DEEPSEEK Fiyat Tahmini: Piyasa Trendleri ve Yapay Zekâda Yenilik için Gelecek Potansiyelinin Analizi

Giriş: DEEPSEEK’in Piyasadaki Konumu ve Yatırım Değeri

Küresel DePIN Chain (DEEPSEEK), kuruluşundan bu yana gelir akışlarını topluluğa yeniden aktaran öncü bir yapay zeka ekosistemi olarak öne çıkıyor. 2025 yılı itibarıyla DEEPSEEK’in piyasa değeri $74.450,0 seviyesinde bulunuyor, dolaşımda yaklaşık 500.000.000 adet token mevcut ve fiyatı $0,0001489 civarında seyrediyor. “Topluluk odaklı gelir dağıtımına sahip ilk yapay zeka ekosistemi” olarak nitelendirilen varlık, kullanıcı tarafından üretilen veri ve internet gezinme faaliyetlerinin değer yapısını yeniden tanımlamada giderek daha kritik bir rol üstleniyor.

Bu makalede, 2025-2030 döneminde DEEPSEEK fiyat trendleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler dikkate alınarak detaylı biçimde analiz edilecek. Yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. DEEPSEEK Fiyat Geçmişi ve Güncel Piyasa Durumu

DEEPSEEK Tarihsel Fiyat Seyri

- 2025: Proje 31 Ocak’ta başlatıldı, fiyat $0,073756 ile tüm zamanların en yüksek seviyesini gördü.

- 2025: Sert piyasa düşüşüyle fiyat 30 Ekim’de $0,0001455 ile tüm zamanların en düşük seviyesine indi.

- 2025: Dalgalı piyasa döngüsü sonucunda fiyat, zirveden mevcut seviyeye %99,43 oranında geriledi.

DEEPSEEK Güncel Piyasa Durumu

2 Kasım 2025 itibarıyla DEEPSEEK $0,0001489 seviyesinden işlem görüyor. 24 saatlik işlem hacmi $11.076,64. Son 24 saatte token %2,73 oranında değer kaybetti. DEEPSEEK’in piyasa değeri $74.450 ve kripto piyasasında 5.414. sırada yer alıyor. Dolaşımdaki arz 500.000.000 DEEPSEEK token; bu rakam toplam arzın %50’sini oluşturuyor (toplam arz: 1.000.000.000). Token’ın tam seyreltilmiş değeri ise $148.900.

DEEPSEEK, farklı zaman dilimlerinde negatif performans sergiliyor; son bir haftada %19,08, son 30 günde ise %17,41 oranında düşüş yaşandı. En belirgin kayıp yıllık bazda görülüyor; fiyat tüm zamanların en yüksek seviyesinden %99,43 oranında geriledi.

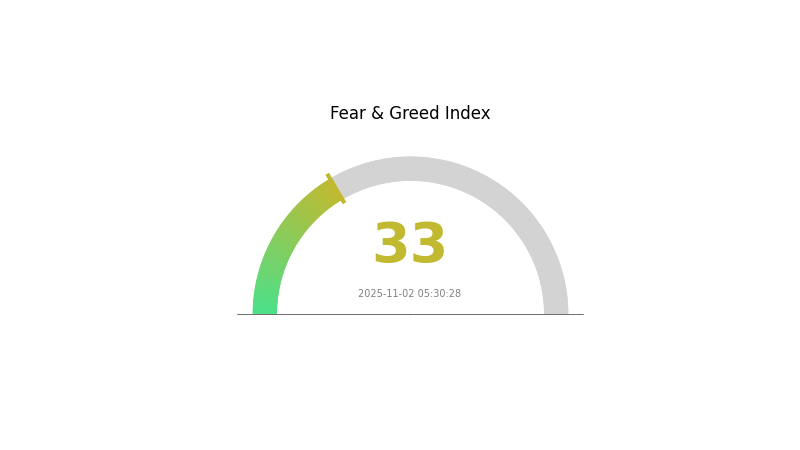

Kripto para piyasasında şu anda baskın eğilim “korku” yönünde; VIX endeksi 33 seviyesinde, bu da genel piyasada yüksek oynaklık ve belirsizliğe işaret ediyor.

Mevcut DEEPSEEK piyasa fiyatını görüntülemek için tıklayın

DEEPSEEK Piyasa Duyarlılığı Göstergesi

2025-11-02 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda korku hakimiyetinde; endeks 33 seviyesinde. Bu, yatırımcılar arasında temkinli bir ruh hali olduğunu gösteriyor ve mevcut eğilime karşı hareket edenler için alım fırsatı sunabilir. Fakat piyasa psikolojisinin hızla değişebileceğini unutmamak gerekir. Yatırımcılar dikkatli olmalı, kapsamlı araştırma yapmalı ve Gate.com’daki risk yönetim araçlarını kullanarak belirsizliği etkin şekilde yönetmelidir.

DEEPSEEK Varlık Dağılımı

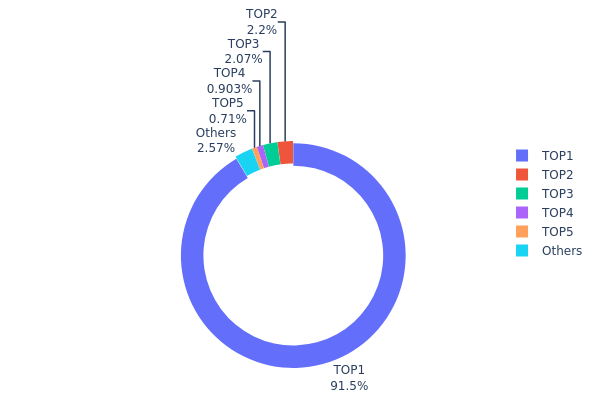

Adres bazlı varlık dağılımı, DEEPSEEK tokenlarının cüzdanlar arasında ne ölçüde yoğunlaştığını gösteriyor. Analiz, son derece merkezi bir dağılımı ortaya koyuyor; en büyük adres toplam arzın %91,54’ünü (457.583,18K token) elinde tutuyor. Sonraki dört büyük sahip toplamda yalnızca %5,87’lik paya sahipken, diğer tüm adresler bir arada %2,59’luk bir bölümü kontrol ediyor.

Bu aşırı yoğunlaşma, token’ın piyasa yapısı ve fiyat oynaklığı açısından ciddi riskler anlamına geliyor. Tek bir adresin böylesine baskın olması, manipülasyon ve ani fiyat dalgalanması riskini artırıyor. En büyük adresin yapacağı büyük hareketler, DEEPSEEK’in piyasa dinamiği ve likiditesi üzerinde ciddi etki yaratabilir.

Genel olarak bu dağılım, DEEPSEEK’in merkeziyetsizlik derecesinin düşük olduğunu ve zincir üstü yapısal istikrarının sorgulanabilir olduğunu gösteriyor. Projenin avantajları bulunsa da mevcut token dağılımı yatırımcılar ve piyasa oyuncuları açısından dikkatle değerlendirilmesi gereken riskler barındırıyor.

Mevcut DEEPSEEK Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 457.583,18K | 91,54% |

| 2 | FAEDsh...VZ1oE6 | 11.001,38K | 2,20% |

| 3 | 9CZnfU...gMvmkK | 10.329,46K | 2,06% |

| 4 | 5fsZEF...TS3wt5 | 4.512,96K | 0,90% |

| 5 | 9sjGfH...Mk7PtW | 3.549,20K | 0,71% |

| - | Diğerleri | 12.869,57K | 2,59% |

II. DEEPSEEK’in Gelecek Fiyatını Etkileyecek Temel Unsurlar

Kurumsal ve Balina Hareketleri

- Kurumsal Varlıklar: Alibaba ve Baidu gibi büyük Çinli yapay zeka şirketlerinin hisse fiyatları, DeepSeek’in tetiklediği AI dalgası sayesinde yükseldi.

- Kurumsal Benimseme: Özellikle AI uygulama katmanında faaliyet gösteren verimli algoritma veya merkeziyetsiz hesaplama odaklı girişimler, DeepSeek teknolojisinden faydalanabilir.

- Ulusal Politikalar: Çin’in AI sektörüne yönelik politika desteği, DeepSeek ve ilgili şirketler için Çin piyasasında avantaj sunabilir.

Makroekonomik Ortam

- Jeopolitik Faktörler: ABD-Çin teknoloji savaşı, DeepSeek bağlantılı hisselerde belirsizliğe yol açıyor. ABD’nin AI çipleri ihracatına yönelik kısıtlamaları, DeepSeek’in tedarik zincirini ve ilgili şirketleri olumsuz etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Düşük Maliyetli AI Modelleri: DeepSeek’in R1 ve V3 modelleri, yaklaşık $6 milyon maliyetle geliştirildi ve OpenAI gibi yüksek maliyetli rakipleriyle yarışıyor.

- Açık Kaynak Stratejisi: DeepSeek’in açık kaynak yaklaşımı ve verimli algoritmaları, AI geliştirme engellerini azaltarak sektörün yapısını değiştirmeye aday.

- Ekosistem Uygulamaları: DeepSeek teknolojisi, özellikle Çin piyasasında akıllı sağlık ve otonom sürüş gibi alanlarda AI benimsenmesini hızlandırabilir.

III. DEEPSEEK 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: $0,00012 - $0,00015

- Nötr tahmin: $0,00015 - $0,00018

- İyimser tahmin: $0,00018 - $0,00022 (olumlu piyasa koşulları gerektirir)

2026-2027 Görünümü

- Piyasa evresi beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2026: $0,00013 - $0,00026

- 2027: $0,00014 - $0,00025

- Temel katalizörler: Artan benimseme, teknolojik ilerleme

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: $0,00024 - $0,00029 (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: $0,00029 - $0,00032 (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: $0,00032 - $0,00038 (çığır açıcı inovasyonlar varsayımıyla)

- 2030-12-31: DEEPSEEK $0,00038 (potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00022 | 0,00015 | 0,00012 | 0 |

| 2026 | 0,00026 | 0,00018 | 0,00013 | 23 |

| 2027 | 0,00025 | 0,00022 | 0,00014 | 50 |

| 2028 | 0,00028 | 0,00024 | 0,00017 | 59 |

| 2029 | 0,00032 | 0,00026 | 0,0002 | 74 |

| 2030 | 0,00038 | 0,00029 | 0,00015 | 93 |

IV. DEEPSEEK Profesyonel Yatırım Stratejileri ve Risk Yönetimi

DEEPSEEK Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: AI ve veri ekosistemine inanan uzun vadeli yatırımcılar

- Operasyonel öneriler:

- Piyasa düşüşlerinde DEEPSEEK token biriktirin

- Dalgalanmalara karşı en az 1-2 yıl elde tutun

- Token’larınızı saklama hizmeti olmayan bir cüzdanda güvenle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit edin

- RSI: Aşırı alım/aşırı satım durumlarını izleyin

- Salınım ticareti için ana noktalar:

- Teknik göstergelere dayalı net giriş-çıkış noktaları belirleyin

- Risk yönetimi için zarar durdur emirleri kullanın

DEEPSEEK Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Atağı yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımlarınızı birden fazla AI ve veri odaklı projeye paylaştırın

- Zarar durdur emirleri: Olası kayıpları sınırlandırmak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulaması kullanın, özel anahtarlarınızı paylaşmayın

V. DEEPSEEK Potansiyel Riskler ve Zorluklar

DEEPSEEK Piyasa Riskleri

- Yüksek oynaklık: Fiyat kısa sürede ciddi şekilde dalgalanabilir

- Sınırlı likidite: Büyük tutarlarda alım-satımda zorluk yaşanabilir

- Rekabet: Diğer AI ve veri projeleri ortaya çıkıp pazar payı kazanabilir

DEEPSEEK Düzenleyici Riskler

- Veri gizliliği: Veri toplama uygulamalarına yönelik düzenleyici inceleme riski

- Kripto düzenlemeleri: Değişen küresel mevzuat operasyonları etkileyebilir

- Vergi sonuçları: Kripto varlıkların vergilendirilmesindeki belirsizlik veya değişim

DEEPSEEK Teknik Riskler

- Akıllı kontrat açıkları: Protokolde istismar veya hata riski

- Ölçeklenebilirlik sorunları: Ağ büyüdükçe teknik zorluklar yaşanabilir

- Merkeziyet riski: Chrome uzantısı ve pazar yerine bağımlılık

VI. Sonuç ve Eylem Önerileri

DEEPSEEK Yatırım Değeri Değerlendirmesi

DEEPSEEK, AI ve veri paraya çevirme alanında yenilikçi bir yaklaşım sunuyor ve büyüyen veri ekonomisinde uzun vadeli potansiyele sahip. Ancak piyasa oynaklığı, düzenleyici belirsizlikler ve teknik zorluklar nedeniyle kısa vadede kayda değer risklerle karşı karşıya.

DEEPSEEK Yatırım Önerileri

✅ Yeni başlayanlar: Projeyi tanımak için küçük ve araştırma amaçlı yatırımlar düşünebilir ✅ Tecrübeli yatırımcılar: Yüksek riskli portföyünüzün bir kısmını ayırıp piyasayı yakından takip edin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapıp, çeşitlendirilmiş bir AI/veri portföyünde değerlendirin

DEEPSEEK Alım-Satım Katılım Yöntemleri

- Spot alım-satım: DEEPSEEK tokenlarını Gate.com’da alıp tutun

- Staking: Pasif gelir için mevcut staking programlarına katılın

- DePIN Chain Pazar Yeri: Ekosistemde veri satışıyla yer alın (uygulanabilir olduğunda)

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatli şekilde vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

DeepSeek coin’in geleceği nedir?

DeepSeek coin’in değerinin düşerek 2025 Kasım’ında $0,0₁₂3320 seviyesine gerilemesi bekleniyor. Piyasa görünümü mevcut trendlere paralel olarak negatif.

DeepSeek AI’nin gelecekteki fiyatı nedir?

DeepSeek AI’nin fiyatının, güncel piyasa trendlerine göre 26 Ekim 2025’te $0,0124518 olması bekleniyor.

Dent $1 seviyesine ulaşabilir mi?

Dent’in büyüme potansiyeli olsa da kısa vadede $1 seviyesine erişmesi düşük ihtimal. Tahminler, 2026’da $0,0011 seviyesine ulaşabileceğini gösteriyor, bu da oldukça uzun bir yol anlamına geliyor.

2025’te hangi AI coin yükseliş yaşayacak?

VIRTUAL, Virtuals Protocol’ün tokenı olarak, güncel trendler ve uzman öngörülerine göre 2025’te öne çıkacak coin olarak görülüyor.

2025 HOLO Fiyat Tahmini: Halving Sonrası Kripto Piyasasında Trendler ve Büyüme Potansiyeli Analizi

2025 COOKIE Fiyat Tahmini: Dijital Cookie Ekonomisi için Piyasa Analizi ve Gelecek Perspektifi

2025 GEOD Fiyat Tahmini: Piyasa Trendleri ve Yatırımcılar İçin Büyüme Potansiyelinin Analizi

2025 SIREN Fiyat Tahmini: Gelecek Perspektifi, Piyasa Analizi ve Bu Gelişen Kripto Varlığı Şekillendiren Temel Dinamikler

2025 BNKR Fiyat Tahmini: Dijital Varlık Sektöründe Piyasa Eğilimleri ve Büyüme Potansiyelinin Analizi

2025 AVAAI Fiyat Tahmini: Genişleyen Yapay Zeka Sektöründe AVAAI'nin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi