2025 BPrice Tahmini: Piyasa Trendleri ve Blockchain Varlık Değerlerinin Geleceğine Yönelik Analiz

Giriş: B'nin Piyasadaki Konumu ve Yatırım Potansiyeli

BuildOn (B), BSC ekosisteminin inşa kültürünü simgeleyen maskotu olarak çıktığı günden bu yana önemli başarılara imza attı. 2025 yılı itibariyle BuildOn’un piyasa değeri 488.200.000 $’a ulaştı; yaklaşık 1.000.000.000 token dolaşımda ve fiyatı 0,4882 $ seviyelerinde. “BSC İnşa Maskotu” olarak adlandırılan bu varlık, USD1’in zincir üstünde bir değer olarak kabul görmesinde giderek kritik bir rol üstleniyor.

Bu makalede, BuildOn’un 2025-2030 dönemindeki fiyat dinamikleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde değerlendirilecek, yatırımcılara profesyonel fiyat tahminleriyle birlikte uygulanabilir stratejiler sunulacaktır.

I. B Fiyat Geçmişi ve Güncel Piyasa Görünümü

B Fiyatlarının Tarihsel Seyri

- Mayıs 2025: B, 0,1327 $ ile piyasaya sürüldü ve tarihi en düşük seviyesini gördü.

- Ağustos 2025: B, açılış fiyatına göre %458 artışla 0,7414 $ ile tüm zamanların zirvesine ulaştı.

- Eylül 2025: B’de düzeltme yaşandı ve fiyat 0,4882 $’a geriledi.

B Mevcut Piyasa Durumu

19 Eylül 2025 itibarıyla B, 0,4882 $ seviyesinden işlem görüyor; bu, zirveye göre %34,15’lik bir değer kaybına işaret ediyor. Token son dönemde aşağı yönlü seyir izledi; 24 saatte %4,42, 7 günde %10,38 ve 30 günde %13,68 geriledi. Buna rağmen, B’nin çıkış fiyatına göre %268’lik anlamlı bir değer kazanımı söz konusu.

B’nin piyasa değeri şu anda 488.200.000 $ olup, kripto para piyasasında 170. sıradadır. Dolaşımdaki ve toplam B token miktarı 1.000.000.000’dur; proje tam dolaşıma ulaşmış durumdadır. 24 saatlik işlem hacmi 497.108,62 $ ile makul seviyede piyasa aktivitesi göstermektedir.

B’nin piyasa egemenliği %0,011 ile düşük ve geniş kripto ekosisteminde hâlen niş bir konumdadır. Tüm tokenlar dolaşımda olduğu için tam seyreltilmiş değer ile piyasa değeri aynıdır.

Güncel B piyasa fiyatını görüntülemek için tıklayın.

İstendiği üzere orijinal İngilizce içerik:

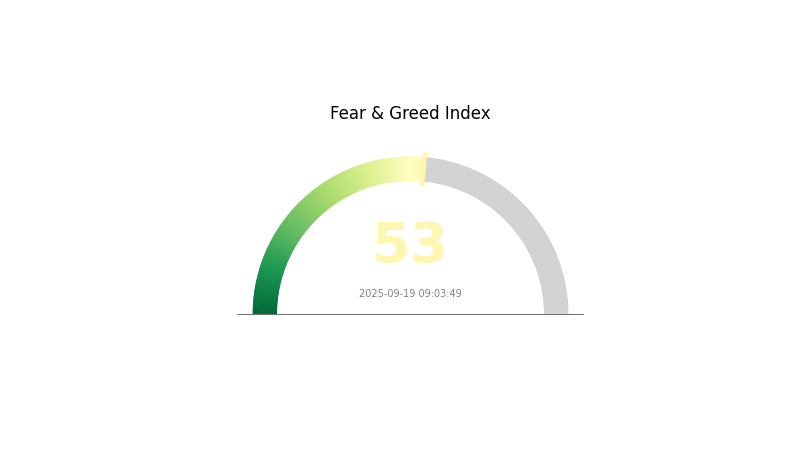

B Piyasa Algı Göstergesi

19 Eylül 2025 Korku ve Açgözlülük Endeksi: 53 (Nötr)

Güncel Korku ve Açgözlülük Endeksi için tıklayın.

Kripto para piyasasında algı nötr seviyede ve Korku ve Açgözlülük Endeksi 53’ü gösteriyor. Bu dengeli ortamda yatırımcılar ne aşırı iyimser ne de kötümser. Piyasanın dikkatle izlenmesi, kapsamlı analiz ve araştırmaya dayalı kararlar alınması için doğru bir zaman. Algı göstergeleri önemli fikirler sunsa da, başarılı bir yatırım için teknik ve temel analizle birlikte kullanılmalıdır.

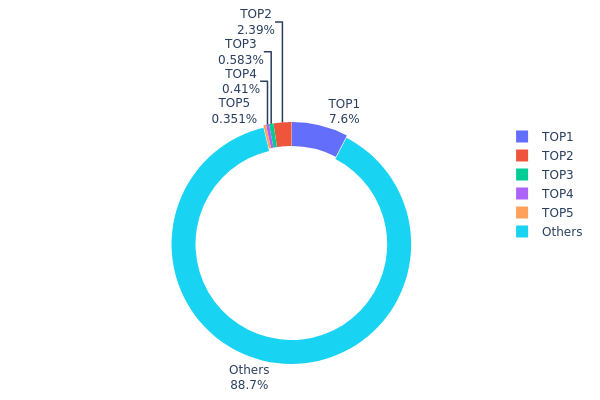

B Varlık Dağılımı

Adres bazlı varlık dağılımı, B tokenlarının cüzdanlar arasında ne ölçüde toplandığına dair kritik bilgiler sunar. Analize göre en büyük adres toplam arzın %7,60’ına, yani 75.974.140 tokena sahip. İkinci büyük sahip %2,39’luk bir paya sahipken, ilk 5 adresin hiçbiri %1’i geçmiyor. Tokenların %88,67’si ise diğer adresler arasında dağılmış durumda.

Bu yapı, B tokenında merkeziyetsizliği işaret ediyor; hiçbir adres belirgin bir ağırlığa sahip değil. En büyük adresin %7,60’lık payı önemli fakat aşırı yoğunlaşma oluşturmuyor. Bu dağılım, piyasada istikrara katkı sağlayabilir ve büyük bir oyuncunun manipülasyon riskini azaltır. Fakat en büyük sahiplerin ortak hareketleri hâlen piyasayı etkileyebilir.

Mevcut dağılım, B ekosisteminde sağlam bir merkeziyetsizliği gösteriyor. Tokenların geniş bir yelpazeye yayılması, piyasa yapısının güçlü ve tekil zafiyetlere karşı dirençli olmasını sağlıyor. Bu durum, uzun vadeli istikrarı destekler ve merkeziyetsiz finans ilkeleriyle uyumludur.

Güncel B Varlık Dağılımını incelemek için tıklayın.

| Sıra | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 75.974,14K | 7,60% |

| 2 | 0xffa8...44cd54 | 23.901,44K | 2,39% |

| 3 | 0xf819...c873aa | 5.822,79K | 0,58% |

| 4 | 0x203d...c9a8c0 | 4.099,74K | 0,41% |

| 5 | 0x0f0c...f022e0 | 3.508,26K | 0,35% |

| - | Diğerleri | 886.054,12K | 88,67% |

B’nin Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Arzı: Toplam 1.000.000.000 B token

- Mevcut Etki: Sınırlı arz, kıtlık yaratarak fiyatı destekleyebilir

Kurumsal ve Balina Hareketleri

- Kurumsal Benimseme: BUILDon (B) 2025 yılında çıktı, BNB Smart Chain üzerinde faaliyet göstermektedir

Makroekonomik Çevre

- Enflasyona Karşı Koruma: B, kripto özelliğiyle potansiyel enflasyon riskine karşı koruma olarak değerlendirilebilir

Teknik Gelişim ve Ekosistem İnşası

- BNB Chain Ekosistemi: B, BNB Chain’in bir parçası; bu, ağ etkisi ve ek fayda sağlayabilir

- AI Entegrasyonu: B, yapay zekâ temalı meme projeleriyle ilişkilidir ve bu teknolojiden yararlanabilir

- Ekosistem Uygulamaları: B, Four.Meme ve WLFI ekosistemlerine dahildir; bu, ek kullanım alanı ve değer katabilir

III. 2025-2030 Dönemi için B Fiyat Tahmini

2025 Görünümü

- Temkinli: 0,37538 $ - 0,4875 $

- Nötr: 0,4875 $ - 0,56794 $

- İyimser: 0,56794 $ - 0,64838 $ (pozitif piyasa şartları gerektirir)

2027-2028 Görünümü

- Piyasa fazı: Büyüme potansiyeli

- Beklenen fiyat aralığı:

- 2027: 0,48331 $ - 0,94704 $

- 2028: 0,49605 $ - 1,11211 $

- Kilit katalizörler: Benimseme, teknoloji gelişimi, düzenleyici belirlilik

2030 Uzun Vadeli Tahmin

- Temel senaryo: 0,87196 $ - 1,08995 $ (istikrarlı piyasa büyümesi durumunda)

- İyimser: 1,08995 $ - 1,54773 $ (güçlü piyasa performansında)

- Radikal: 1,54773 $ üzeri (aşırı pozitif koşullarda)

- 31 Aralık 2030: B 1,08995 $ (2025’e kıyasla %123 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,64838 | 0,4875 | 0,37538 | 0 |

| 2026 | 0,73832 | 0,56794 | 0,46003 | 16 |

| 2027 | 0,94704 | 0,65313 | 0,48331 | 33 |

| 2028 | 1,11211 | 0,80008 | 0,49605 | 63 |

| 2029 | 1,22381 | 0,9561 | 0,74576 | 95 |

| 2030 | 1,54773 | 1,08995 | 0,87196 | 123 |

IV. B için Uzman Yatırım Stratejileri ve Risk Yönetimi

B Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun hedef kitle: Risk toleransı yüksek ve uzun vadeli bakış açısına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde B tokenı biriktirmek

- Kısmi kazanç için fiyat hedefleri belirlemek

- Varlıkları güvenli cüzdanlarda saklayıp düzenli güvenlik kontrolü yapmak

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemek için

- RSI: Aşırı alım/satım durumlarını izlemek için

- Swing trade için önemli noktalar:

- BNB Smart Chain ekosistem gelişimini takip etmek

- USD1’in benimsenme verileri ve likidite havuzlarını izlemek

B Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Aggresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün en fazla %15’i

(2) Riskten Korunma Yöntemleri

- Çeşitli BSC projelerine portföy dağılımı

- Olası zararları sınırlamak için zarar durdur emri kullanımı

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk cüzdan (donanım cüzdanı): Büyük miktarlar için

- Güvenlik için iki faktörlü doğrulama ve güçlü şifreler kullanımı

V. B için Olası Riskler ve Zorluklar

B Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında keskin fiyat hareketleri

- Likidite: BSC üzerinde USD1 likiditesinde zorluklar yaşanabilir

- Rekabet: Benzer özelliklere sahip alternatif BSC projeleri

B Düzenleyici Riskler

- Stablecoin regülasyonları: USD1 gelişimini etkileyebilir

- BSC ekosistemi denetimi: BNB Smart Chain’e özel regülasyon baskısı

- Uluslararası engeller: Kripto düzenlemelerinde ülkeye göre farklılıklar

B Teknik Riskler

- Akıllı kontrat açıkları: B ve USD1 sözleşmelerinde istismar riski

- Ağ tıkanıklığı: İşlem yoğunluğunda gecikmeler

- İnteroperabilite: Zincirler arası USD1 transferlerinde teknik sorunlar

VI. Sonuç ve Eylem Tavsiyeleri

B Yatırım Potansiyeli Değerlendirmesi

B, BSC ekosisteminde USD1’in kullanımı odaklı özgün bir fırsat sunar. Büyüme potansiyeli barındırsa da, yatırımcıların kripto yatırımlarındaki yüksek riski ve projenin USD1 başarısına bağımlılığını göz önünde bulundurması gerekir.

B Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla sürece dahil olun, BSC ekosistemini öğrenmeye odaklanın

✅ Deneyimli yatırımcılar: Çeşitlendirilmiş BSC portföyünün bir parçası olarak B’yi değerlendirin

✅ Kurumsal yatırımcılar: B’yi kapsamlı BSC ve stablecoin stratejileri dahilinde analiz edin

B Ticaret Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden B token alım-satımı

- Likidite sağlama: B/USD1 likidite havuzlarına katılım (mevcut ise)

- Staking: BSC üzerinde B staking opsiyonlarını değerlendirin Staking

Kripto para yatırımları yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Her yatırımcı kendi risk toleransına göre hareket etmeli, profesyonel finans danışmanlarına başvurmalı ve asla kaybetmeyi göze alacağından fazlasını yatırmamalıdır.

Sıkça Sorulan Sorular

Bitcoin 1 milyar $’a ulaşır mı?

Bitcoin etkileyici bir büyüme gösterse de, bir coin’in 1 milyar $ seviyesine çıkması beklenemez. Bu fiyat, küresel varlığın ötesinde gerçek dışı bir piyasa değerine işaret eder.

Boeing için strateji ne olmalı?

Boeing şu anda piyasa konsensüsüne göre “al” notu ile değerlendirilmekte. Hisse Baa3 ortalama derecesine sahip olup, 54 analistin önerisi “al” yönünde.

B kripto için fiyat tahmini nedir?

19 Eylül 2025 itibariyle, mevcut piyasa trendleri ve kullanıcı algısına dayanarak tahmini B fiyatı 0,015 $’dır.

BRK B 10 yıl sonra ne kadar olur?

Mevcut trendler temelinde, BRK.B'nin 10 yıl içinde 2,7-3 trilyon $ piyasa değerine ulaşması öngörülmektedir; %10-11 yıllık büyümeyle hisse başı fiyat yaklaşık 1.200-1.300 $ olur.

PORT3 ve BNB: DeFi ve NFT Geliştirme Açısından İki Blockchain Ekosisteminin Karşılaştırılması

2025 yılında BNB fiyatı hangi seviyelere ulaşacak? Temel tahminler ve analizler

2030 yılına kadar BNB’nin fiyat oynaklığı nasıl bir değişim gösterecek?

KLO ve BNB: Dijital finans dünyasında dengeleri değiştiren kripto para mücadelesi

Hedera (HBAR) 2025 Fiyat Analizi ve Yatırım Olanakları

Avalanche (AVAX) 2025 Fiyat Analizi ve Piyasa Trendleri

BAS nedir: Bina Otomasyon Sistemleri ve Modern Akıllı Binalara Etkileri Üzerine Kapsamlı Bir Rehber

COAI Fiyat Dalgalanması Nedir: ChainOpera AI Kripto 2025’te Neden 25 $’dan 0,45 $’a Düştü?