2025 AOG Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: AOG'nin Piyasa Konumu ve Yatırım Potansiyeli

AgeOfGods (AOG), yeni nesil NFT aksiyon kart oyunu olarak sektöre güçlü bir giriş yaptı. 2025 yılı itibarıyla AOG'nin piyasa değeri 93.571,93 ABD doları, dolaşımdaki arzı yaklaşık 103.474.429 token ve fiyatı 0,0009043 ABD doları civarında seyrediyor. Oyun ve NFT alanında yenilikçi yaklaşımıyla bilinen bu varlık, blokzincir tabanlı oyun sektöründe etkisini giderek artırıyor.

Bu makale, AOG'nin 2025-2030 dönemindeki fiyat hareketlerini; tarihsel gelişim, piyasa arz-talep dengesi, ekosistem büyümesi ve makroekonomik etkenler doğrultusunda analiz ederek yatırımcılara profesyonel fiyat projeksiyonları ve uygulamaya dönük stratejiler sunacaktır.

I. AOG Fiyat Geçmişi ve Mevcut Piyasa Durumu

AOG Fiyat Geçmişi

- 2022: Lansman dönemi, fiyat 6 Ocak'ta 1,12 ABD doları ile zirveye ulaştı

- 2023: Piyasa düşüşü, fiyat ciddi oranda geriledi

- 2025: Ayı piyasası devam etti, fiyat 24 Eylül’de 0,0007638 ABD doları ile dip seviyeyi gördü

AOG Güncel Piyasa Durumu

2 Kasım 2025 itibarıyla AOG, 0,0009043 ABD doları seviyesinden işlem görüyor. Son 24 saatte %0,15'lik hafif bir düşüş yaşandı; işlem hacmi ise 9.964,92 ABD doları. AOG'nin piyasa değeri 93.571,93 ABD doları olup, kripto para sıralamasında 5.151. sırada yer alıyor.

Haftalık bazda AOG, %3,82 oranında daha belirgin bir düşüş gösterdi. Ancak son 30 günde token %7,62 artışla kısmi bir toparlanma yaşadı. Kısa vadeli bu yükselişe rağmen, AOG'nin fiyatı bir yıl öncesine göre %72,7 düşük ve piyasanın genel ayı eğilimini yansıtıyor.

Dolaşımdaki toplam miktar 103.474.429 AOG olup, bu rakam toplam arzın %38,32'sine karşılık geliyor (toplam arz: 270.000.000 AOG). Tam seyreltilmiş piyasa değeri ise 244.161,00 ABD dolarıdır.

Güncel AOG fiyatını görüntülemek için tıklayın

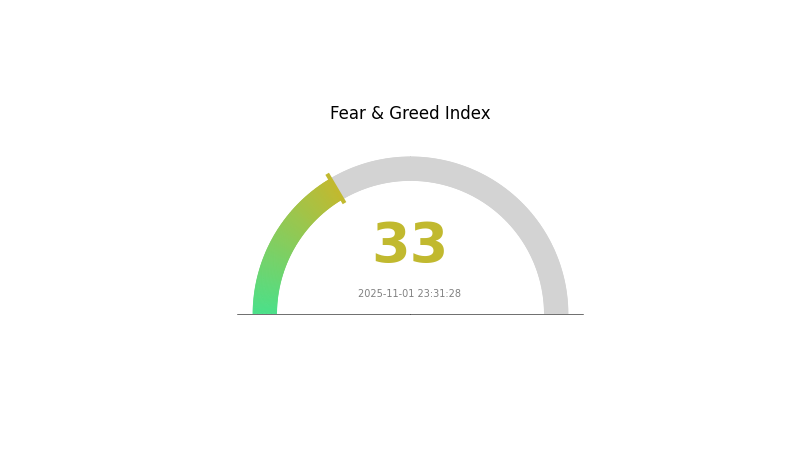

AOG Piyasa Duyarlılığı Göstergesi

2025-11-01 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku ve Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasasında korku hakim; Korku ve Açgözlülük Endeksi 33 seviyesinde. Yatırımcılar temkinli bir yaklaşım sergilerken, bu durum kontraryen yatırımcılar için alım fırsatları yaratabilir. Ancak piyasa duyarlılığı hızlı değişebilir. Her zaman olduğu gibi, yatırım öncesi kapsamlı araştırma ve etkili risk yönetimi şarttır. Gate.com’da bilinçli ve dikkatli işlem yapın.

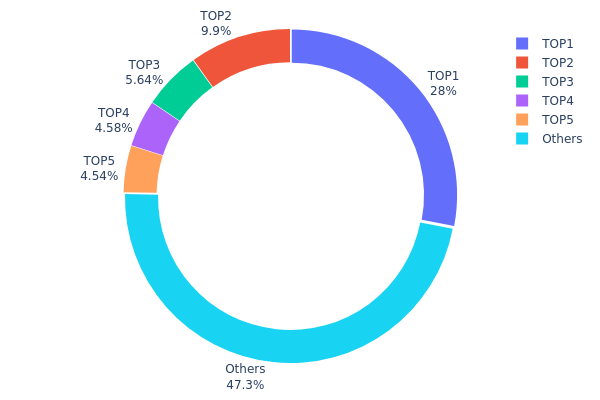

AOG Varlık Dağılımı

AOG’de adres bazlı varlık dağılımı incelendiğinde, tokenların büyük kısmı az sayıda adreste toplanıyor. En büyük sahip toplam arzın %28,01’ini elinde bulundururken, ilk beş adresin toplam payı %52,64. Bu derece yoğunlaşma, merkeziyetçi bir sahiplik yapısına işaret ediyor ve piyasa dinamiklerine doğrudan etki edebilir.

Yoğunlaşma, AOG fiyatında yüksek volatiliteye neden olabilir. "Balina" olarak adlandırılan büyük sahipler, işlemleriyle piyasada belirleyici rol oynayabilir. Ayrıca, bu yapı piyasa manipülasyonu riskini artırır; büyük sahiplerin koordineli hareketleriyle fiyatlar yönlendirilebilir.

Öte yandan, AOG tokenlarının %47,36'sı diğer adreslerde bulunuyor. Bu, küçük yatırımcılar arasında bir miktar dağılımı gösterirken, piyasa istikrarı ve likiditeye katkı sağlayabilir. Ancak genel yapı, üst düzey sahiplerin ekosistem ve fiyat üzerinde orantısız etkilere yol açabileceğini gösteriyor.

Güncel AOG Varlık Dağılımı’nı görüntülemek için tıklayın

| Üst | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xeaed...6a6b8d | 75.634,54K | 28,01% |

| 2 | 0x0d07...b492fe | 26.729,76K | 9,89% |

| 3 | 0x65c2...749f97 | 15.225,53K | 5,63% |

| 4 | 0xab14...2fa7a3 | 12.366,31K | 4,58% |

| 5 | 0xbc92...e80861 | 12.246,16K | 4,53% |

| - | Diğerleri | 127.797,71K | 47,36% |

II. AOG'nin Gelecek Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Piyasa Duyarlılığı: Yatırımcı psikolojisi ve beklentiler, AOG'nin fiyat dalgalanmalarında başat rol oynar.

Kurumsal ve Balina Etkileri

- Ulusal Politikalar: Hükümet regülasyonları ve politika değişiklikleri, AOG'nin fiyatı ve benimsenmesini doğrudan etkiler.

Makroekonomik Ortam

- Para Politikası Etkisi: Büyük ekonomilerin merkez bankası kararları, AOG’nin değerini etkiler.

- Enflasyona Karşı Dayanıklılık: Enflasyonist dönemlerde AOG'nin performansı fiyat üzerinde belirleyicidir.

- Jeopolitik Faktörler: Küresel ilişkiler ve çatışmalar AOG'nin piyasa dinamiklerine yön verebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Düzenleyici Ortam: Regülasyonların gelişimi, AOG fiyatı için temel belirleyicidir.

III. 2025-2030 Dönemi AOG Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,00082 - 0,00090 ABD doları

- Tarafsız tahmin: 0,00090 - 0,00095 ABD doları

- İyimser tahmin: 0,00095 - 0,00101 ABD doları (güçlü piyasa ivmesiyle)

2026-2028 Görünümü

- Piyasa fazı: Kademeli büyüme ve olası dalgalanma

- Fiyat aralığı öngörüleri:

- 2026: 0,00063 - 0,00099 ABD doları

- 2027: 0,00061 - 0,00118 ABD doları

- Başlıca katalizörler: Benimseme artışı, teknolojik gelişmeler ve piyasa algısı

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00109 - 0,00116 ABD doları (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00123 - 0,00136 ABD doları (olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,00136+ ABD doları (çok olumlu piyasa gelişmeleri)

- 2030-12-31: AOG 0,00136 ABD doları (iyimser öngörüye göre zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,00101 | 0,0009 | 0,00082 | 0 |

| 2026 | 0,00099 | 0,00096 | 0,00063 | 5 |

| 2027 | 0,00118 | 0,00098 | 0,00061 | 7 |

| 2028 | 0,00111 | 0,00108 | 0,00059 | 19 |

| 2029 | 0,00123 | 0,00109 | 0,00066 | 21 |

| 2030 | 0,00136 | 0,00116 | 0,00081 | 28 |

IV. AOG Yatırım Stratejileri ve Risk Yönetimi

AOG Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Blokzincir oyunlarına ilgisi olan, risk toleransı yüksek kişiler

- İşlem önerileri:

- Piyasa düşüşlerinde AOG biriktirin

- Kısmi kar için fiyat hedefleri belirleyin

- Tokenları güvenli, saklama hizmeti sunmayan cüzdanlarda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalarla trend takibi

- RSI: Aşırı alım/aşırı satım sinyalleriyle giriş-çıkış noktası belirleme

- Dalgalı işlem için önemli noktalar:

- Destek ve direnç seviyelerini tespit edin

- Risk için stop-loss emirleri kullanın

AOG Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-2’si

- Agresif yatırımcılar: Kripto portföyünün %3-5’i

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %10’u

(2) Riskten Korunma Çözümleri

- Diversifikasyon: AOG’yi diğer oyun tokenları ve mavi çip kripto varlıklarla dengeleyin

- Stop-loss emirleri: Potansiyel kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: 2FA etkinleştir, güçlü şifre kullan, yazılımı düzenli güncelle

V. AOG'nin Karşılaşabileceği Riskler ve Zorluklar

AOG Piyasa Riskleri

- Yüksek volatilite: Oyun token piyasasında fiyat dalgalanmaları aşırı olabilir

- Rekabet: Diğer blokzincir tabanlı oyunlar AOG'nin pazar payını azaltabilir

- Oyun sektörü trendleri: Oyuncu tercihleri ve eğilimler talebi etkileyebilir

AOG Düzenleyici Riskleri

- Belirsiz regülasyonlar: Kripto oyunlarıyla ilgili mevzuat küresel çapta hala şekilleniyor

- Token sınıflandırılması: Bazı ülkelerde AOG’nin menkul kıymet olarak tanımlanma riski

- Sınır ötesi kısıtlamalar: Uluslararası regülasyonlar erişimi sınırlayabilir

AOG Teknik Riskleri

- Akıllı sözleşme açıkları: Token’ın kodunda olası istismarlar

- Blokzincir ağ sorunları: BSC ağındaki tıkanıklık veya kesintiler işlemleri aksatabilir

- Oyun platformu istikrarı: AgeOfGods oyunundaki teknik sorunlar tokenin kullanımını etkileyebilir

VI. Sonuç ve Öneriler

AOG Yatırım Değeri Değerlendirmesi

AOG, blokzincir oyun sektöründe spekülatif bir yatırım fırsatı sunar. Uzun vadeli değer AgeOfGods'ın başarısına bağlıyken, kısa vadede yüksek volatilite ve regülasyon belirsizlikleri risk oluşturmaktadır.

AOG Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Detaylı araştırma sonrası küçük ve deneme amaçlı pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayın ✅ Kurumsal yatırımcılar: Çeşitlendirilmiş oyun token portföyünde AOG'yi değerlendirin

AOG İşlem Katılım Yöntemleri

- Spot işlem: Gate.com’da AOG alım-satımı yapın

- Staking: AgeOfGods platformunda staking seçeneklerini değerlendirin

- Oyun içi harcamalar: AOG’yi AgeOfGods oyun ekosisteminde kullanın

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre hareket etmeli ve profesyonel finansal danışmanlarla görüşmelidir. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Aergo toparlanacak mı?

Aergo’nun toparlanması proje ekibinin başarısı ve piyasa şartlarına bağlıdır. Net bir öngörü bulunmasa da, olumlu gelişmeler ve artan benimseme gelecekte fiyatı yukarı çekebilir.

Aureal One için 2030 fiyat tahmini nedir?

Mevcut projeksiyonlara göre, Aureal One’ın 2030’daki fiyatı 0,19616 ABD doları seviyesine ulaşabilir. Bu, mevcut fiyatlara göre %7.867,69'luk kayda değer bir büyümeye işaret ediyor.

Hamster Kombat coin 1 ABD dolarına ulaşır mı?

Evet, Hamster Kombat coin, blokzincir oyun pazarındaki büyüme ve genel piyasa eğilimiyle 2028 yılına kadar 1 ABD doları seviyesine ulaşabilir.

API3 için 2026 fiyat tahmini nedir?

Teknik analizlere göre, API3’ün 2026’daki fiyatı 11,14 ABD doları olarak öngörülmektedir. Bu tahmin, API3’ün önümüzdeki yıllarda büyüme potansiyeline sahip olduğunu gösteriyor.

ALICE (ALICE) iyi bir yatırım mı?: Bu oyun token’ının günümüz kripto piyasasındaki potansiyeli ve risklerinin analizi

Vulcan Forged (PYR) Yatırım İçin Uygun mu?: Bu Oyun Kripto Parasının Güncel Piyasa Potansiyelinin Değerlendirilmesi

League of Ancients (LOA) iyi bir yatırım mı?: Bu blokzincir tabanlı MOBA oyununun potansiyeli ve riskleri üzerine analiz

R-Games (RGAME) yatırım için uygun mu?: Bu oyun odaklı kripto para biriminin potansiyeli ve riskleri üzerine analiz

Victory Gem (VTG) iyi bir yatırım mı?: Bu yükselen kripto paranın potansiyeli ve riskleri üzerine analiz

Mobox (MBOX) iyi bir yatırım mı?: Bu oyun odaklı kripto paranın potansiyelini ve taşıdığı riskleri analiz etmek

Hotbit platformunun kapanmasının ardından fonlarınızı nasıl çekebilirsiniz

Yapay Zekâ, 2025 yılında büyüme gösterecek 10 kripto parayı öngörüyor | Uzman Analizleri

SMTX nedir: Yüzey Montaj Teknolojisi X ve modern elektronik üretiminde kullanım alanları hakkında kapsamlı bir rehber

SOIL Nedir: Dünya Ekosistemlerinin ve Tarımsal Verimliliğin Temelini Anlamak

KONET nedir: Kore Ulusal Optik Ağ Altyapısına Kapsamlı Bir Rehber