2025 AINN Price Prediction: Navigating the Future of Artificial Intelligence in Financial Markets

Introduction: AINN's Market Position and Investment Value

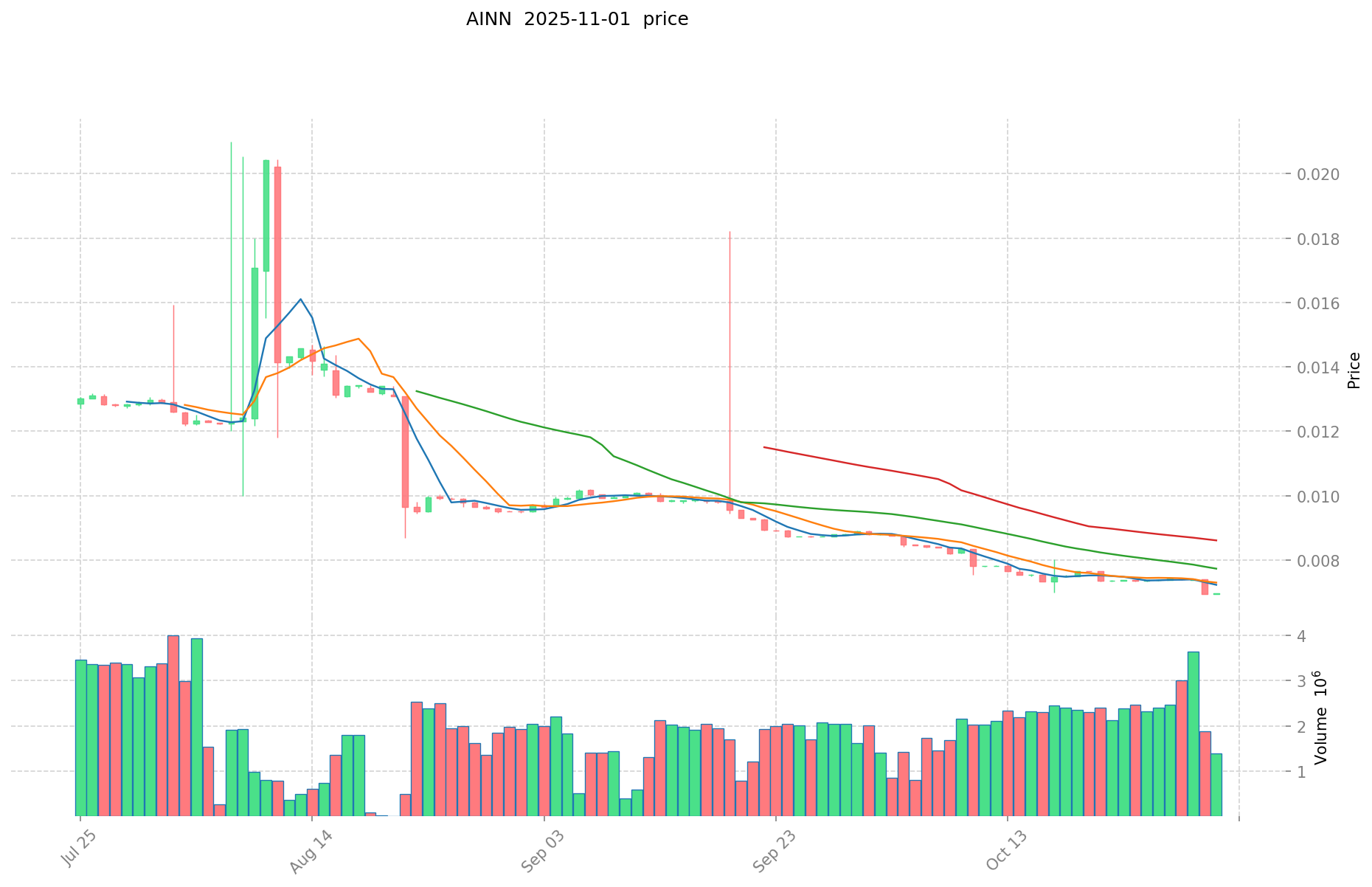

AINN (AINN), as a leaderless inscription based on the BRC20 protocol, has emerged as a strong consensus for the future long-term value of combining web3 and AI since its inception in 2023. As of 2025, AINN's market capitalization has reached $146,496, with a circulating supply of approximately 21,000,000 tokens, and a price hovering around $0.006976. This asset, dubbed the "Web3 and AI integration pioneer," is playing an increasingly crucial role in the development of ecosystem projects and use cases for the AINN inscription.

This article will comprehensively analyze AINN's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. AINN Price History Review and Current Market Status

AINN Historical Price Evolution Trajectory

- 2023: AINN deployed as a leaderless inscription on the BRC20 protocol in May, representing the convergence of Web3 and AI.

- 2024: Reached an all-time high of $2.96 on February 22, signifying peak market enthusiasm.

- 2025: Experienced a significant market correction, with the price dropping to an all-time low of $0.006936 on October 30.

AINN Current Market Situation

As of November 1, 2025, AINN is trading at $0.006976, showing a slight recovery of 0.27% in the last 24 hours. However, the token has experienced substantial declines across various timeframes: -5.24% over the past week, -20.73% in the last month, and a staggering -92.58% over the past year. The current market capitalization stands at $146,496, with a fully diluted valuation matching this figure due to the entire supply being in circulation. AINN's trading volume in the last 24 hours is $9,932.75, indicating moderate market activity. The token's market dominance is relatively low at 0.0000037%, reflecting its niche position in the broader cryptocurrency landscape.

Click to view the current AINN market price

AINN Market Sentiment Indicator

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 33, indicating a fearful atmosphere. Investors appear hesitant, possibly due to recent market fluctuations or global economic uncertainties. This fear-driven environment could present potential buying opportunities for those looking to acquire assets at lower prices. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. As always, diversification and risk management are key in navigating volatile crypto markets.

AINN Holdings Distribution

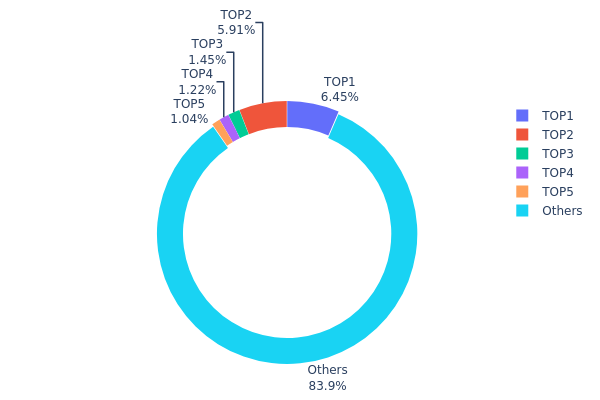

The address holdings distribution data for AINN reveals a relatively decentralized structure. The top holder possesses 6.45% of the total supply, followed by the second-largest holder with 5.91%. The subsequent top addresses hold significantly smaller portions, ranging from 1.45% to 1.04%. Notably, 83.94% of AINN tokens are distributed among numerous other addresses.

This distribution pattern suggests a moderate level of decentralization, as no single address holds an overwhelming majority of tokens. The top two addresses, while holding substantial amounts, do not possess enough to exert unilateral control over the market. The wide distribution among "Others" indicates broad participation and reduces the risk of market manipulation by a few large holders.

However, the concentration of over 12% in the top two addresses warrants monitoring, as coordinated actions by these holders could potentially impact short-term price movements. Overall, the current AINN address distribution reflects a relatively healthy market structure with a good balance between major stakeholders and broader community participation.

Click to view the current AINN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 16G1xY...Vp9Wxh | 1354.76K | 6.45% |

| 2 | 1D4wR9...CkGPYf | 1241.70K | 5.91% |

| 3 | bc1p7r...9pdee5 | 304.61K | 1.45% |

| 4 | bc1pxl...jjjl6w | 255.43K | 1.21% |

| 5 | 35UMBc...57St14 | 218.70K | 1.04% |

| - | Others | 17624.80K | 83.94% |

II. Key Factors Influencing AINN's Future Price

Community and Project Dynamics

- Community engagement: The level of community involvement and participation in the AINN ecosystem significantly impacts its price trajectory.

- Project responsiveness: How well the AINN team addresses issues and implements improvements affects investor confidence and token value.

- Ethical conduct: Any misconduct or unethical behavior by the project team can negatively influence AINN's price.

Macro-Economic Environment

- Market trends: Overall cryptocurrency market sentiment and trends play a crucial role in AINN's price movements.

- Regulatory changes: Shifts in cryptocurrency regulations across different jurisdictions can impact AINN's adoption and value.

III. AINN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00586 - $0.00698

- Neutral prediction: $0.00698 - $0.00800

- Optimistic prediction: $0.00800 - $0.00900 (requires favorable market conditions)

2026-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2026: $0.00759 - $0.00847

- 2027: $0.00469 - $0.01078

- 2028: $0.00485 - $0.01254

- Key catalysts: Technological advancements, market adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.01047 - $0.01306 (assuming steady market growth)

- Optimistic scenario: $0.01306 - $0.01510 (assuming strong adoption and favorable market conditions)

- Transformative scenario: $0.01510 - $0.01607 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: AINN $0.01607 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.009 | 0.00698 | 0.00586 | 0 |

| 2026 | 0.00847 | 0.00799 | 0.00759 | 14 |

| 2027 | 0.01078 | 0.00823 | 0.00469 | 17 |

| 2028 | 0.01254 | 0.0095 | 0.00485 | 36 |

| 2029 | 0.0151 | 0.01102 | 0.01047 | 58 |

| 2030 | 0.01607 | 0.01306 | 0.0098 | 87 |

IV. AINN Professional Investment Strategy and Risk Management

AINN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in Web3 and AI integration

- Operation suggestions:

- Accumulate AINN during market dips

- Hold for at least 3-5 years to realize potential value

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to limit potential losses

AINN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stablecoin reserves: Maintain a portion of portfolio in stablecoins

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. AINN Potential Risks and Challenges

AINN Market Risks

- High volatility: Price fluctuations can be extreme

- Limited liquidity: May affect ability to enter or exit positions

- Market sentiment: Susceptible to rapid shifts in investor sentiment

AINN Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting BRC20 tokens

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance challenges: Evolving KYC/AML requirements for crypto assets

AINN Technical Risks

- Smart contract vulnerabilities: Potential for bugs or exploits

- Scalability issues: Limitations of the underlying Bitcoin network

- Interoperability challenges: Compatibility with other blockchain ecosystems

VI. Conclusion and Action Recommendations

AINN Investment Value Assessment

AINN presents a high-risk, high-potential opportunity in the intersection of Web3 and AI. Long-term value proposition is strong, but short-term volatility and regulatory uncertainties pose significant risks.

AINN Investment Recommendations

✅ Beginners: Start with small, affordable investments; focus on education ✅ Experienced investors: Consider allocating a small portion of portfolio; actively manage risk ✅ Institutional investors: Conduct thorough due diligence; potentially explore for long-term strategic positioning

AINN Participation Methods

- Spot trading: Purchase and hold AINN tokens directly

- DCA strategy: Regularly invest fixed amounts to average out price volatility

- Ecosystem participation: Engage with AINN-related projects and communities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does API3 have a future?

API3 shows promise, with analysts projecting $8-$15 by 2030. Its future hinges on adoption and market trends, making it potentially attractive for long-term investors.

Will pi coin reach $100?

Pi coin could potentially reach $100 by 2030 if it gains widespread adoption and real-world use cases. Some predictions even suggest it might exceed $500.

Can injective protocol reach $100?

Based on current forecasts, Injective protocol is not expected to reach $100 by 2030. Long-term growth is uncertain.

Will Cardano reach $100?

No, Cardano reaching $100 is highly improbable. It would require a market cap of over $3 trillion, which is unrealistic in the current crypto landscape.

Share

Content