Post content & earn content mining yield

placeholder

Chillzzz

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

#USCoreCPIHitsFour-YearLow

US Core CPI just printed a four-year low.

At first glance, that’s a clear disinflation signal.

But markets don’t react to numbers — they react to expectations.

A lower core CPI suggests:

• Inflation pressure is easing

• The Fed may gain room to pivot

• Rate cut probabilities could rise

• Liquidity expectations may improve

That’s typically supportive for risk assets.

But here’s the nuance:

📌 Is this a sustained trend or a one-off drop?

📌 How does services inflation look beneath the surface?

📌 What happens to bond yields and the dollar next?

If yields fall and the

US Core CPI just printed a four-year low.

At first glance, that’s a clear disinflation signal.

But markets don’t react to numbers — they react to expectations.

A lower core CPI suggests:

• Inflation pressure is easing

• The Fed may gain room to pivot

• Rate cut probabilities could rise

• Liquidity expectations may improve

That’s typically supportive for risk assets.

But here’s the nuance:

📌 Is this a sustained trend or a one-off drop?

📌 How does services inflation look beneath the surface?

📌 What happens to bond yields and the dollar next?

If yields fall and the

- Reward

- 1

- 4

- Repost

- Share

Lock_433 :

:

To The Moon 🌕View More

$PANW

It held onto the $163-EMA34 and the $156-support band. The index is still in a negative delta position. If it loses these supports, selling can accelerate toward the lower supports

It held onto the $163-EMA34 and the $156-support band. The index is still in a negative delta position. If it loses these supports, selling can accelerate toward the lower supports

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$12.45K

More Tokens

- Reward

- like

- Comment

- Repost

- Share

If I buy just one Bitcoin and then wait, I will wake up after years a millionaire, God willing.

Bitcoin is much better than gold in my opinion, don't try...

View OriginalBitcoin is much better than gold in my opinion, don't try...

- Reward

- like

- Comment

- Repost

- Share

🔥 New Year Opening Red Packet Rain · 3 Days to Go!

🧧 Feb 17–24, 12:00 UTC

Join Gate Live stream to grab your share of massive red packets!

🎯 Event Highlights:

✅ Up to 88 USDT per red packet, unlimited wins

✅ Extra rewards for continuous participation

✅ Lucky Red Packet: win $50 cash airdrop

📲 Stay tuned — the red packet rain won’t stop, don’t miss out!

👉 Watch now: https://www.gate.com/live

👉 Event details: https://www.gate.com/campaigns/3937

#GateSquare$50KRedPacketGiveaway

🧧 Feb 17–24, 12:00 UTC

Join Gate Live stream to grab your share of massive red packets!

🎯 Event Highlights:

✅ Up to 88 USDT per red packet, unlimited wins

✅ Extra rewards for continuous participation

✅ Lucky Red Packet: win $50 cash airdrop

📲 Stay tuned — the red packet rain won’t stop, don’t miss out!

👉 Watch now: https://www.gate.com/live

👉 Event details: https://www.gate.com/campaigns/3937

#GateSquare$50KRedPacketGiveaway

- Reward

- 1

- 2

- Repost

- Share

Lock_433 :

:

2026 GOGOGO 👊View More

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLGWXVLWAW

View Original

- Reward

- like

- Comment

- Repost

- Share

YouTuber Logan Paul purchased this #NFT for $635,000 in 2021. Today, it’s worth $155. #crypto

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Start the Year of the Horse with a win! Gate Square is hosting a $50,000红包雨 (red envelope rain). Post to join and grab https://www.gate.com/campaigns/4044?ref=U1hMUAhX&ref_type=132.

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQUSXVPBCA

View Original

- Reward

- like

- Comment

- Repost

- Share

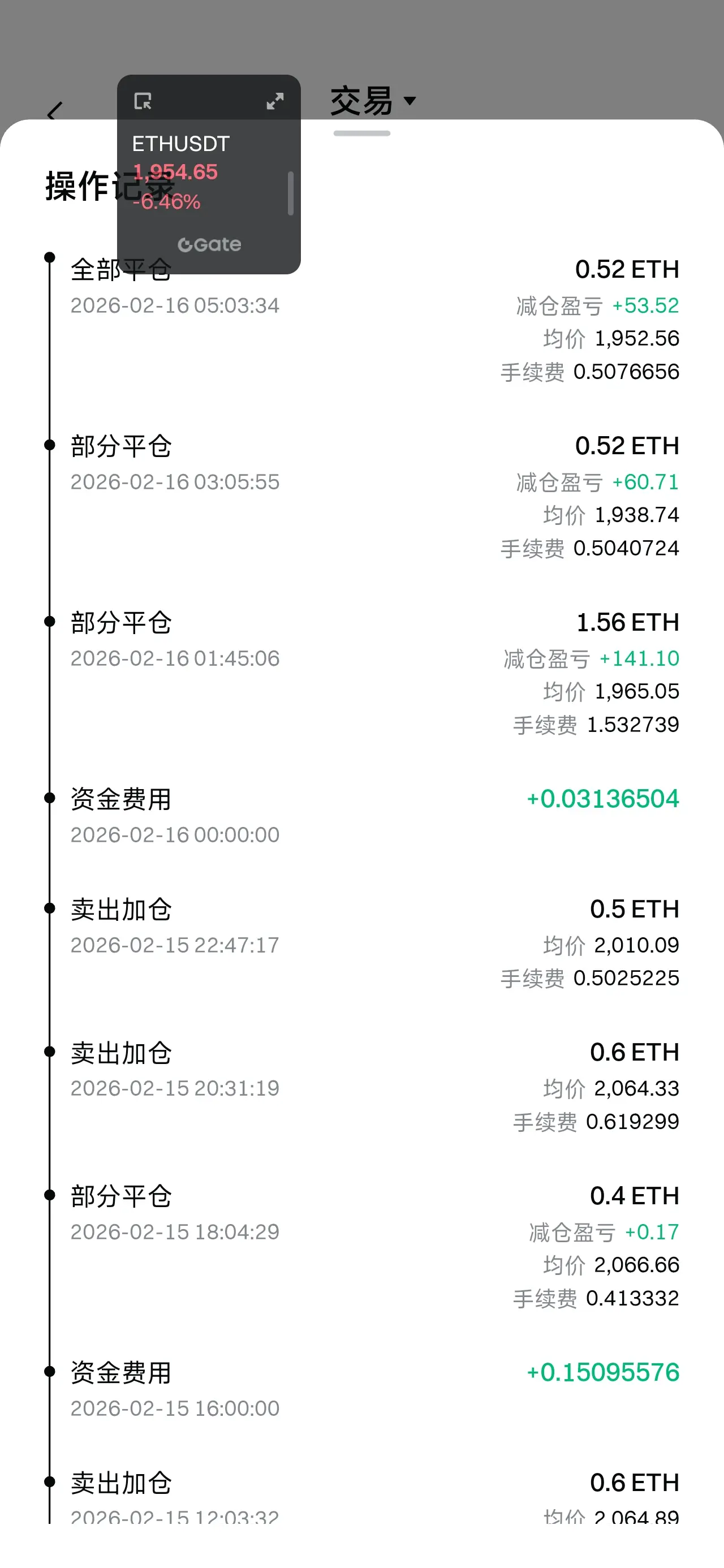

$ETH Short-term trading suggestions for February 16:

ETH: Buy around 1945-1934, take profit near 1970-1995-2025, stop loss if it drops below 1900 and rebounds.

ETH: Short around 1995-2025, take profit near 1975-1950-1900, stop loss if it breaks above 2050 and pulls back.

There is a price difference between platforms; you can buy or sell with a 2-3 USD difference.

Note: When I mention breakouts and breakdowns, I am referring to the candlestick bodies, not price action breakouts or breakdowns.

The two levels given by the host are for light positions and staggered entries. For short-term trades

ETH: Buy around 1945-1934, take profit near 1970-1995-2025, stop loss if it drops below 1900 and rebounds.

ETH: Short around 1995-2025, take profit near 1975-1950-1900, stop loss if it breaks above 2050 and pulls back.

There is a price difference between platforms; you can buy or sell with a 2-3 USD difference.

Note: When I mention breakouts and breakdowns, I am referring to the candlestick bodies, not price action breakouts or breakdowns.

The two levels given by the host are for light positions and staggered entries. For short-term trades

ETH-5,99%

- Reward

- 2

- 1

- Repost

- Share

TheManFromQiWorries :

:

0.1 USD Pi Coin? Youlong's prophecy has caused a stir in the crypto world! Some are preparing to buy the dip, while others are selling overnight. Do you dare to bet on this market trend?芝麻开门

芝麻开门

Created By@DreamJourney

Listing Progress

100.00%

MC:

$2K

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQDGB1SNAQ

View Original

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3998?ref=VQIVU15ZUQ&ref_type=132&utm_cmp=SEz74YgP

- Reward

- like

- Comment

- Repost

- Share

Open Gate TradFi for the first time and unlock double rewards with ease. During the campaign, new users who complete TradFi account opening and designated trading tasks can receive a 100 USDT reward. Complete the tasks within 24 hours after registration to enjoy double rewards. https://www.gate.com/campaigns/4026?ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLNCAAHABA

View Original

- Reward

- like

- Comment

- Repost

- Share

$btc by concept is literally a programmed script, which in theory means it's programmed to go up only.

Time frame time frame time frame

Time frame time frame time frame

BTC-1,42%

- Reward

- like

- Comment

- Repost

- Share

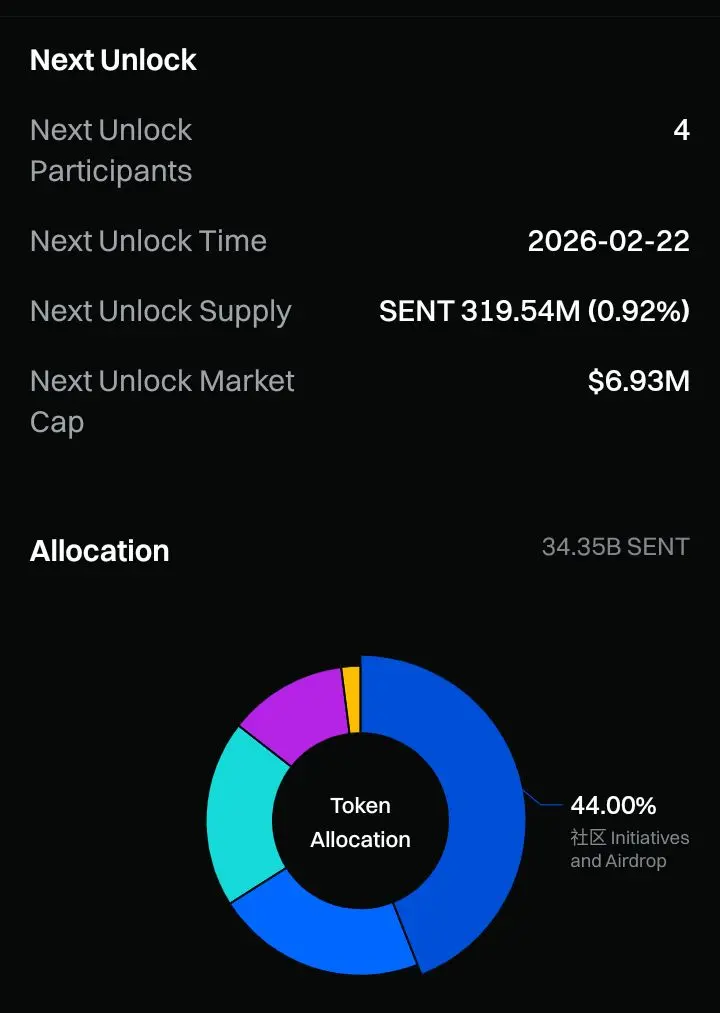

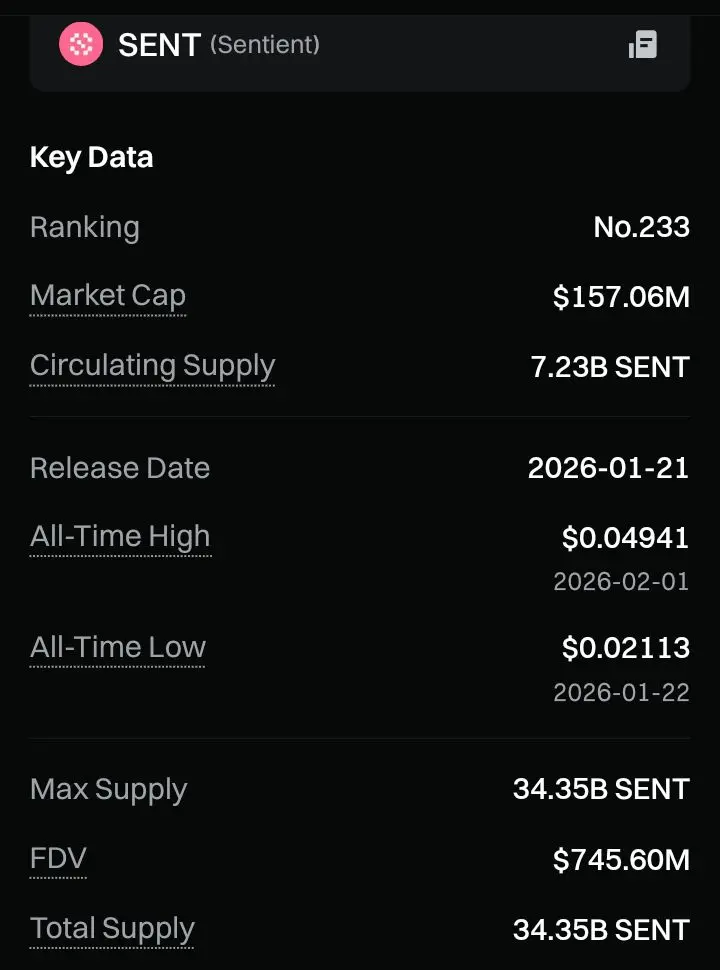

$SENT and the rise of decentralized communication

As Web3 grows, one area remains surprisingly underdeveloped. Communication. While finance, gaming, and NFTs have expanded rapidly, decentralized messaging and community coordination are still evolving. Sent enters this space with a clear objective. Build communication infrastructure that belongs to users, not platforms.

In a digital world shaped by algorithms and data collection, ownership of conversations may become as important as ownership of assets.

What Sent represents

Sent is a Web3 focused communication protocol designed to give users m

As Web3 grows, one area remains surprisingly underdeveloped. Communication. While finance, gaming, and NFTs have expanded rapidly, decentralized messaging and community coordination are still evolving. Sent enters this space with a clear objective. Build communication infrastructure that belongs to users, not platforms.

In a digital world shaped by algorithms and data collection, ownership of conversations may become as important as ownership of assets.

What Sent represents

Sent is a Web3 focused communication protocol designed to give users m

SENT-7,27%

- Reward

- like

- 1

- Repost

- Share

CoinConnoisseur :

:

telegram? signal?Take profit levels at 1960-1940-1900. When it reached 1950 for the last time, I didn't want to wait and manually closed the position. The previous trade had a loss of about 8-9%, and this trade has a profit of over 20% including principal and interest.

View Original

- Reward

- like

- Comment

- Repost

- Share

Happy Sunday, fam

Hope you're doing good

Hope you're doing good

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More119.63K Popularity

19.97K Popularity

17.94K Popularity

62.83K Popularity

8.65K Popularity

Hot Gate Fun

View More- MC:$2.65KHolders:81.19%

- MC:$0.1Holders:10.00%

- MC:$2.45KHolders:10.00%

- MC:$2.45KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreThe Federal Reserve has a 90.2% probability of maintaining interest rates unchanged in March.

5 m

Traditional Finance Alert: EURTRY Has Increased by Over 3%

8 m

Data: 500 BTC transferred from an anonymous address, worth approximately 34.2 million USD

59 m

Data: 1,413,800 tons transferred out from the kiln, and after transit, flows into tons

1 h

Data: 318.24 BTC transferred from an anonymous address, routed through a relay, and flowed into Duelbits

2 h

Pin