# silver

456.82K

TopCryptoNews

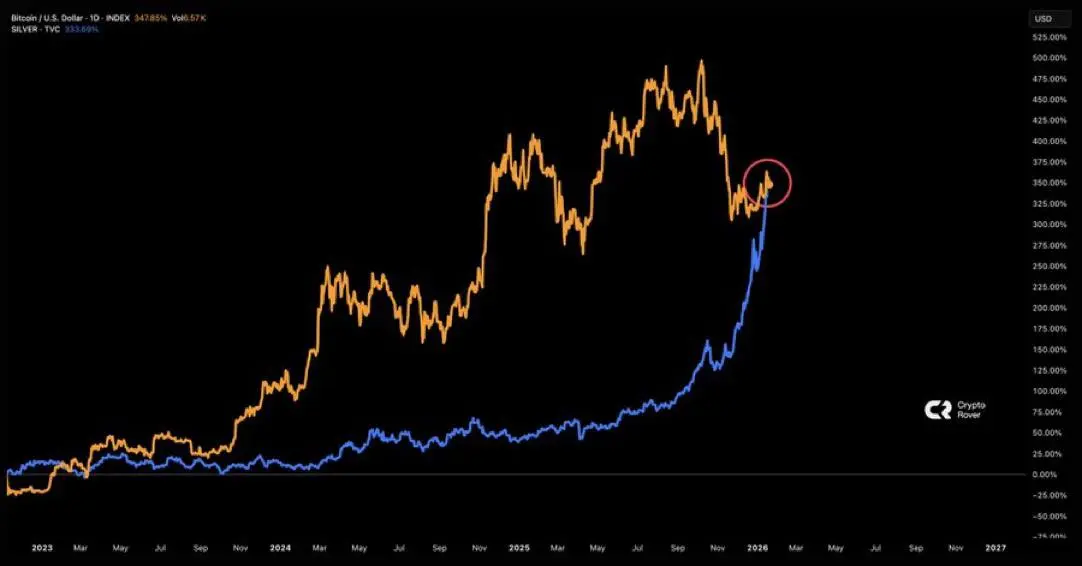

💰Capital flow from Silver to $BTC ?

Analysts note that historically, the BTC/Silver exchange rate reached its minimum 13 months after the peak, showing a drop of 75-85% 📉

At the moment, it's the twelfth month, and the collapse is already at 78%.

According to this dynamic, a capital flow from Silver to BTC could start in the first half of 2026.

#BTC #Bitcoin #Silver $BTC

Analysts note that historically, the BTC/Silver exchange rate reached its minimum 13 months after the peak, showing a drop of 75-85% 📉

At the moment, it's the twelfth month, and the collapse is already at 78%.

According to this dynamic, a capital flow from Silver to BTC could start in the first half of 2026.

#BTC #Bitcoin #Silver $BTC

BTC-0,22%

- Reward

- 10

- 6

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

🔥 PRECIOUS METALS RALLY | GOLD & SILVER vs BTC & ETH — THE SHOWDOWN IS ON 🔥

Markets are heating up, momentum is building, and one question is dominating trader conversations right now 👀

👉 Will traditional safe havens take the crown… or will crypto giants defend their dominance?

This is not just trading.

This is a full-scale market battle — and you get to choose a side.

⚔️ CHOOSE YOUR TEAM

🟡 Team Gold & Silver

The classic powerhouses. Inflation hedges. Macro-driven strength.

🔵 Team BTC & ETH

Digital dominance. Volatility. Momentum fueled by liquidity and sentiment.

Pick your team, trade w

Markets are heating up, momentum is building, and one question is dominating trader conversations right now 👀

👉 Will traditional safe havens take the crown… or will crypto giants defend their dominance?

This is not just trading.

This is a full-scale market battle — and you get to choose a side.

⚔️ CHOOSE YOUR TEAM

🟡 Team Gold & Silver

The classic powerhouses. Inflation hedges. Macro-driven strength.

🔵 Team BTC & ETH

Digital dominance. Volatility. Momentum fueled by liquidity and sentiment.

Pick your team, trade w

- Reward

- 5

- 2

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

Precious Metals Rally|Gold & Silver vs. BTC & ETH Showdown Is Heating Up!

Pick Team Gold & Silver or BTC & ETH, trade with market momentum, and share a massive $68,000 prize pool, with up to $10,500 per individual

💎 Join Now and Claim Glory:

https://www.gate.com/activities/crypto-team-battle/xau-vs-btc-perps-24

🏆 Team Leaderboard: 1st place wins $10,000

🎁 New User Bonus: Sign up and trade to earn $10

⭐ Trading Star: Win up to $500 individually, regardless of team results

📢 Announcement:

https://www.gate.com/announcements/article/49426

#BTC #ETH #Gold #Silver #PreciousMetals

Pick Team Gold & Silver or BTC & ETH, trade with market momentum, and share a massive $68,000 prize pool, with up to $10,500 per individual

💎 Join Now and Claim Glory:

https://www.gate.com/activities/crypto-team-battle/xau-vs-btc-perps-24

🏆 Team Leaderboard: 1st place wins $10,000

🎁 New User Bonus: Sign up and trade to earn $10

⭐ Trading Star: Win up to $500 individually, regardless of team results

📢 Announcement:

https://www.gate.com/announcements/article/49426

#BTC #ETH #Gold #Silver #PreciousMetals

- Reward

- 7

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

- Reward

- like

- Comment

- Repost

- Share

# GoldandSilverHitNewHighs

🏆 Gold &

Silver hit NEW HIGHS! 🏆

Driven by central bank buying and safe-haven demand, we

might see some institutional money rotate away from crypto short-term.

But zoom out 🧐: This strengthens

Bitcoin's 'digital gold' narrative in the long run.

💡 Strategy:

Monitor the rotation between metals and crypto. Keep your portfolio balanced

and watch for consolidation setups.

#Gold #Silver

🏆 Gold &

Silver hit NEW HIGHS! 🏆

Driven by central bank buying and safe-haven demand, we

might see some institutional money rotate away from crypto short-term.

But zoom out 🧐: This strengthens

Bitcoin's 'digital gold' narrative in the long run.

💡 Strategy:

Monitor the rotation between metals and crypto. Keep your portfolio balanced

and watch for consolidation setups.

#Gold #Silver

BTC-0,22%

- Reward

- like

- Comment

- Repost

- Share

🚨😨😵💫 MARKET ALERT: 4US Economic Events to Influence Bitcoin, Gold, and Silver Prices This Week! 🚨

‼️ READ BELOW ‼️

Buckle up! We are heading into a "perfect storm" of economic volatility where the worlds of TradFi and Crypto are about to collide. As the U.S. economy faces a pivotal week, the spotlight isn't just on Wall Street it’s on Bitcoin, Gold, and Silver.

⚡️Here is why your portfolio is about to get a serious adrenaline shot:

🔥 The "Big 4" Economic Catalysts:

We are tracking four massive U.S. economic events that could act as a detonator for price action. From critical inflation d

‼️ READ BELOW ‼️

Buckle up! We are heading into a "perfect storm" of economic volatility where the worlds of TradFi and Crypto are about to collide. As the U.S. economy faces a pivotal week, the spotlight isn't just on Wall Street it’s on Bitcoin, Gold, and Silver.

⚡️Here is why your portfolio is about to get a serious adrenaline shot:

🔥 The "Big 4" Economic Catalysts:

We are tracking four massive U.S. economic events that could act as a detonator for price action. From critical inflation d

BTC-0,22%

- Reward

- like

- Comment

- Repost

- Share

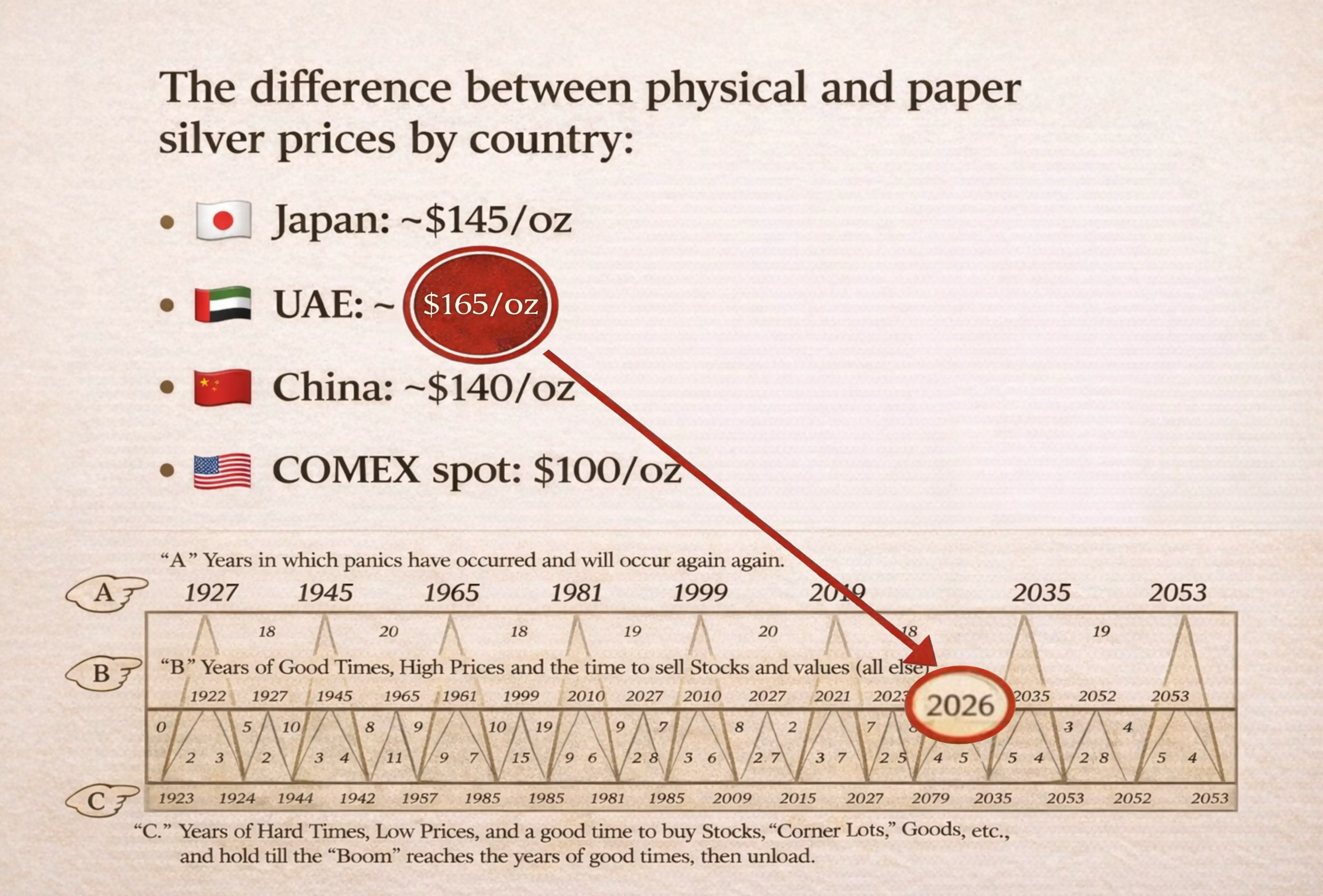

WARNING: #SILVER IS FLASHING A SYSTEM RISK SIGNAL… AND THE GAP CAN NO LONGER BE IGNORED

COMEX shows silver near 100 per ounce but that number is no longer real. The physical market has broken away with Japan clearing around 145 the UAE near 165 and China around 140. A forty to sixty percent spread is not a discount. It is a signal that the paper market has detached from reality.

Physical demand is overwhelming supply. Solar manufacturers are consuming annual output China is tightening exports and strategic reserves are at historic lows. The cheap price is only for paper claims that depend on

COMEX shows silver near 100 per ounce but that number is no longer real. The physical market has broken away with Japan clearing around 145 the UAE near 165 and China around 140. A forty to sixty percent spread is not a discount. It is a signal that the paper market has detached from reality.

Physical demand is overwhelming supply. Solar manufacturers are consuming annual output China is tightening exports and strategic reserves are at historic lows. The cheap price is only for paper claims that depend on

BTC-0,22%

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

5K Gold or $100 Silver Which One Leads the Next Move?

Has BTC Already Peaked This Cycle?

Over the past few months, the traditional “safe-haven” playbook has quietly flipped.

Gold is hovering near record territory, while silver has exploded into the long-discussed $100/oz zone. This isn’t random price action—it’s capital repositioning.

Gold’s strength is being fueled by: • Rising geopolitical instability

• Historic levels of sovereign debt

• Central banks aggressively increasing physical reserves

Silver, meanwhile, is riding two powerful forces: • A more accessible alternative to gold for small

Has BTC Already Peaked This Cycle?

Over the past few months, the traditional “safe-haven” playbook has quietly flipped.

Gold is hovering near record territory, while silver has exploded into the long-discussed $100/oz zone. This isn’t random price action—it’s capital repositioning.

Gold’s strength is being fueled by: • Rising geopolitical instability

• Historic levels of sovereign debt

• Central banks aggressively increasing physical reserves

Silver, meanwhile, is riding two powerful forces: • A more accessible alternative to gold for small

- Reward

- like

- Comment

- Repost

- Share

#GoldandSilverHitNewHighs ⚡ #GoldandSilverHitNewHighs – 19 Jan 2026

Precious metals are back in the spotlight! Gold has surged past $2,050/oz, while silver hits $27.50/oz, marking new multi-year highs. This surge reflects global market uncertainty, inflation concerns, and the flight to safety amid ongoing macroeconomic turbulence.

📌 Market Overview:

Gold: Strong upward momentum driven by rising inflation expectations and geopolitical tensions.

Silver: Benefiting from both industrial demand and investor hedge demand, showing higher volatility than gold.

Correlation with Crypto: BTC and other d

Precious metals are back in the spotlight! Gold has surged past $2,050/oz, while silver hits $27.50/oz, marking new multi-year highs. This surge reflects global market uncertainty, inflation concerns, and the flight to safety amid ongoing macroeconomic turbulence.

📌 Market Overview:

Gold: Strong upward momentum driven by rising inflation expectations and geopolitical tensions.

Silver: Benefiting from both industrial demand and investor hedge demand, showing higher volatility than gold.

Correlation with Crypto: BTC and other d

BTC-0,22%

- Reward

- 8

- 17

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

Silver is on 🔥!

From its 2022 lows, it’s surging so fast that it’s about to overtake Bitcoin’s multi-year gains and it did in months what BTC took 4 years to do.

While Bitcoin rose ~400% from $18k to $91k over 3.5 years, silver shot ~350%+ from ~$20 to $90 in a fraction of the time.

Different assets, different drivers, but the speed of silver’s rally is absolutely insane.

#silver #btc

From its 2022 lows, it’s surging so fast that it’s about to overtake Bitcoin’s multi-year gains and it did in months what BTC took 4 years to do.

While Bitcoin rose ~400% from $18k to $91k over 3.5 years, silver shot ~350%+ from ~$20 to $90 in a fraction of the time.

Different assets, different drivers, but the speed of silver’s rally is absolutely insane.

#silver #btc

BTC-0,22%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

19.41K Popularity

83.27K Popularity

31.16K Popularity

11.66K Popularity

13.05K Popularity

10.96K Popularity

10.5K Popularity

10.26K Popularity

75.74K Popularity

23.04K Popularity

83.31K Popularity

21.87K Popularity

51.78K Popularity

44.95K Popularity

180.32K Popularity

News

View MoreTesla's stock price increased by 3% after hours

2 h

Tesla's stock price rose 4% after hours, with Q4 earnings per share exceeding expectations

2 h

U.S. stocks close with mixed gains and losses; Intel rises 11%

2 h

Chris Grisanti: Federal Reserve statement leans hawkish, inflation becomes the primary concern

3 h

Spot gold breaks through $5350/oz, reaching a new all-time high

3 h

Pin