Volatile Start for Crypto ETFs in February as Bitcoin Lags and XRP Shines

A volatile first full week of February left crypto exchange-traded funds (ETFs) sharply divided, with bitcoin and ether absorbing sustained pressure while XRP quietly delivered a strong showing. Rapid daily reversals underscored a market still searching for conviction.

Extreme Reversals Mark Crypto ETFs as XRP Defies Market Stress

The first week of February delivered sharp mood swings across crypto ETFs, with heavy selling early in the week giving way to late rebounds that ultimately fell short of reversing broader losses.

Bitcoin spot ETFs closed the Feb. 2–6 window with a net outflow of -$318 million, despite a powerful late-week bounce. Blackrock’s IBIT oscillated violently, absorbing large outflows midweek before rebounding strongly on Friday, finishing the week with a -$115.14 million drawdown.

Fidelity’s FBTC bore sustained pressure, logging heavy redemptions across multiple sessions and ending the week deeply negative with a -$166.73 million exit. Grayscale’s GBTC (-$173.82 million) contributed a sizable weekly outflow of -$173.82 million, although its Bitcoin Mini Trust finished modestly positive with $18.39 million net inflow.

Bitwise’s BITB and Ark & 21Shares’ ARKB also remained net sellers, while smaller allocations into Invesco’s BTCO and Wisdomtree’s BTCW provided only marginal relief. Friday’s $371 million inflow underscored renewed dip-buying interest, but it wasn’t enough to offset earlier damage in the week.

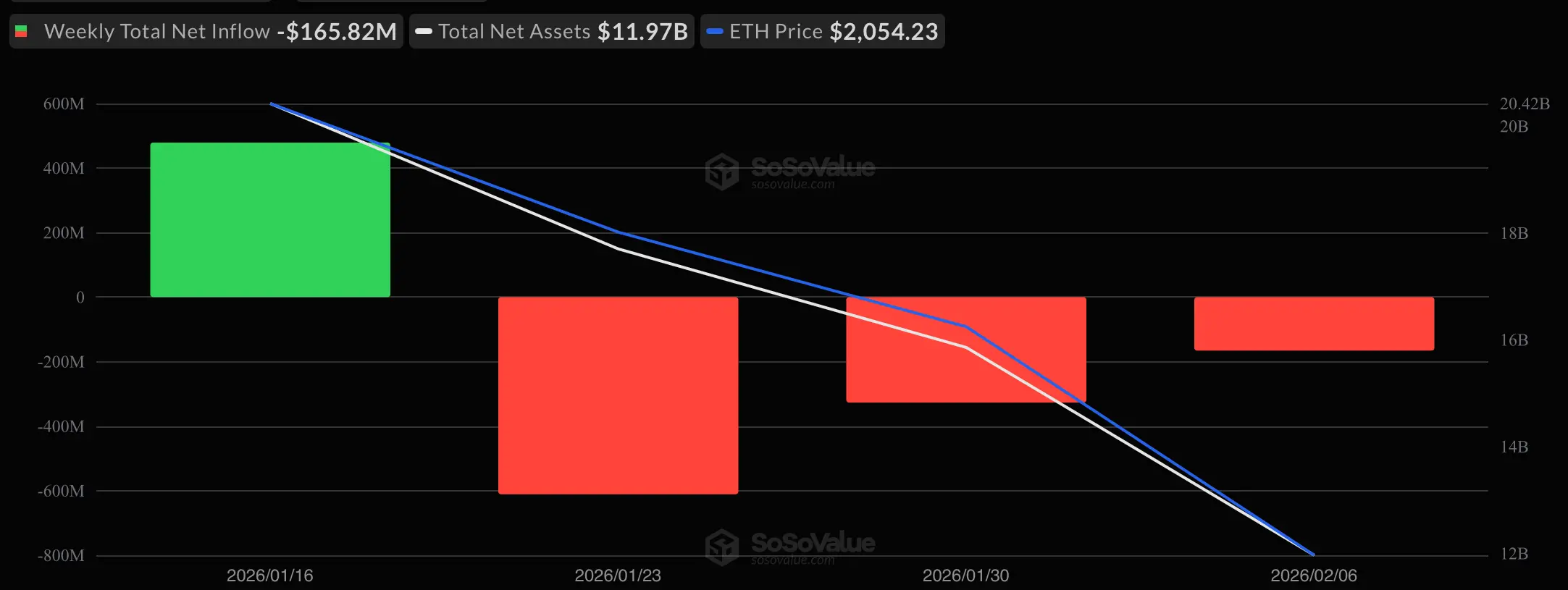

Ether spot ETFs recorded -$166 million in net weekly outflows, extending their fragile trend. Blackrock’s ETHA (-$152.16 million) led the drawdowns with consistent redemptions, firmly anchoring ether ETF weakness. Fidelity’s FETH (-$59.89 million) added meaningful losses, particularly midweek.

Grayscale’s ETHE (-$18.83 million) and Ether Mini Trust ($32.97 million) saw mixed flows, with brief inflows unable to counter persistent selling. Smaller products like Bitwise’s ETHW($16.79 million), Vaneck’s ETHV ($8.19 million), and Invesco’s QETH ($7.13 million) provided intermittent support but lacked scale, as subdued conviction remained around ether exposure.

Three consecutive weekly outflows for ether ETFs.

XRP spot ETFs stood apart as the clear winner, posting $39 million in net weekly inflows. Franklin’s XRPZ ($20.50 million) and Bitwise’s XRP ($20.01 million) consistently attracted capital throughout the week, while Canary’s XRPC ($3.44 million) added steady secondary support. Grayscale’s GXRP briefly saw redemptions but failed to derail the broader trend. XRP’s resilience marked a strong rebound from last week’s net outflows.

Three consecutive weekly outflows for ether ETFs.

XRP spot ETFs stood apart as the clear winner, posting $39 million in net weekly inflows. Franklin’s XRPZ ($20.50 million) and Bitwise’s XRP ($20.01 million) consistently attracted capital throughout the week, while Canary’s XRPC ($3.44 million) added steady secondary support. Grayscale’s GXRP briefly saw redemptions but failed to derail the broader trend. XRP’s resilience marked a strong rebound from last week’s net outflows.

Solana spot ETFs ended the week with -$8.9 million in net outflows, despite pockets of buying. Bitwise’s BSOL (-$8.61 million) saw notable midweek redemptions, partially offset by inflows into Fidelity’s FSOL ($5.19 million). Grayscale’s GSOL leaned negative, while smaller products such as Vaneck’s VSOL, Franklin’s SOEZ, and 21Shares’ TSOL fluctuated without establishing momentum.

Read more: ETF Recap: Crypto ETFs End January in Deep Retreat With $1.8 Billion Exit

Overall, the week captured a market still struggling to stabilize. Bitcoin and ether remain trapped in volatile push-and-pull dynamics, Solana searched for footing, and XRP emerged quietly but decisively, as the standout in an otherwise unsettled ETF market.

FAQ 📊

- Why were crypto ETFs so volatile in early February?

Rapid risk-on, risk-off rotations drove sharp daily reversals as investors lacked conviction.

- How did bitcoin ETFs perform for the week?

Bitcoin ETFs saw a $318 million net outflow despite strong dip-buying late in the week.

- Why did ether ETFs stay under pressure?

Persistent redemptions from large funds like ETHA and FETH outweighed smaller inflows.

- What explains XRP ETFs outperforming the market?

Consistent inflows suggest renewed confidence in XRP amid broader crypto ETF stress.

Related Articles

Yesterday, the US Bitcoin ETF saw a net inflow of 417 BTC, and the Ethereum ETF experienced a net inflow of 10,536 ETH.

Rising Stablecoin Inflows Hint at Early Accumulation Despite Bitcoin Decline

Data: In the past 24 hours, the total liquidation across the network was $266 million, with long positions liquidated at $143 million and short positions at $123 million.