Book loss of $5.2 billion! Strategy invests an additional $90 million and increases Bitcoin holdings by 1,142 units

8m ago

Bitmine sweeps 40,613 ETH in a single week! Tom Lee: A "V-shaped rebound" is expected this year

16m ago

Trending Topics

View More202.91K Popularity

3.13K Popularity

4.3K Popularity

7.2K Popularity

2.43K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$2.4KHolders:10.00%

- MC:$0.1Holders:00.00%

- MC:$2.4KHolders:10.00%

- MC:$2.4KHolders:10.00%

Pin

Ethereum's Pragmatic Moment: Interpreting "V God"'s Strategic Reconfiguration of the Layer 2 Roadmap

Author: YQ, Crypto KOL;

Translation: Jin Cai Financial

Since 2015, I have been deeply involved in research on scalability. From sharding technology, Plasma, application chains to Rollup, I have personally witnessed all the iterations of these technical routes. In 2021, I founded AltLayer, focusing on app Rollup and Rollup-as-a-Service solutions, maintaining close cooperation with all mainstream Rollup tech stacks and teams within the ecosystem. Therefore, when Vitalik proposed fundamentally restructuring our understanding of L2, I naturally paid close attention. His recent article marks a milestone in this regard.

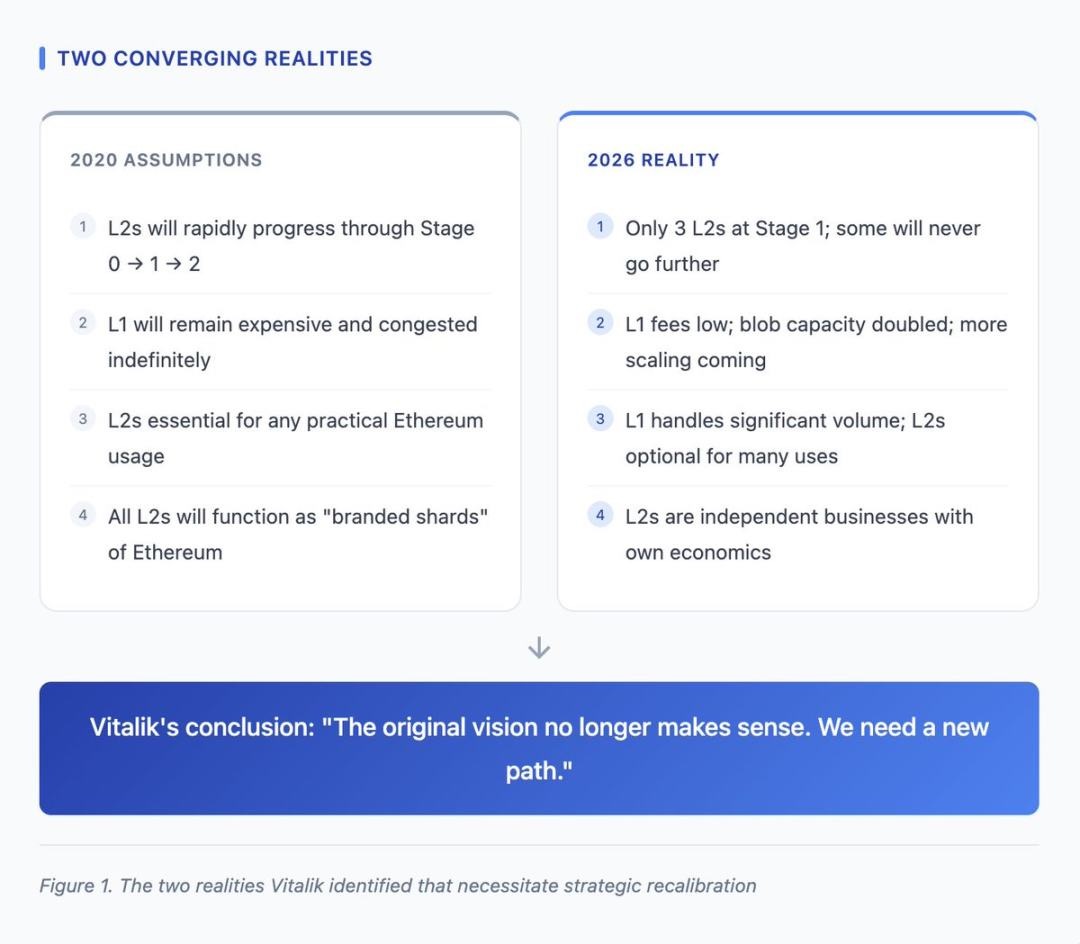

What Vitalik has done is not easy. Acknowledging that the core assumptions of 2020 did not materialize as expected—this honest attitude is something most leaders lack. The roadmap centered on Rollup was built on the premise that “L2 will serve as Ethereum-branded sharding.” Four years of market data, however, paint a different picture: L2 has evolved into autonomous platforms with independent economic incentives; the scalability of Ethereum L1 has exceeded expectations; the original framework is now disconnected from the current reality.

Continuing to defend the old narrative would be easier. Continuing to push teams to chase visions that the market has discredited is also simpler. But true leadership should not be so. Admitting the gap between expectations and reality, proposing new paths, and moving toward a brighter future—that is the responsibility we should bear. And Vitalik’s discourse exemplifies this approach.

What is reality?

Vitalik points out two intertwined realities that together necessitate strategic adjustments. First, the decentralization process of L2 is slower than expected. Currently, only three major L2s (Arbitrum, OP Mainnet, Base) have reached the first stage of decentralization, and some L2 teams have explicitly stated that due to regulatory requirements or business model constraints, they may never pursue full decentralization. This is not a moral flaw but reflects the economic reality that sequencer revenue is the primary business model for L2 operators.

Second, Ethereum L1 has achieved substantial scalability. Transaction fees are low, the Pectra upgrade doubled data block capacity, and the gas limit will continue to increase before 2026. Initially, the Rollup roadmap assumed high L1 costs and congestion, but that premise is no longer valid. L1 can now handle large volumes of transactions at reasonable costs, changing the value proposition of L2: from “a necessity for guaranteed availability” to “an optional choice for specific scenarios.”

Reconstructing the trust spectrum

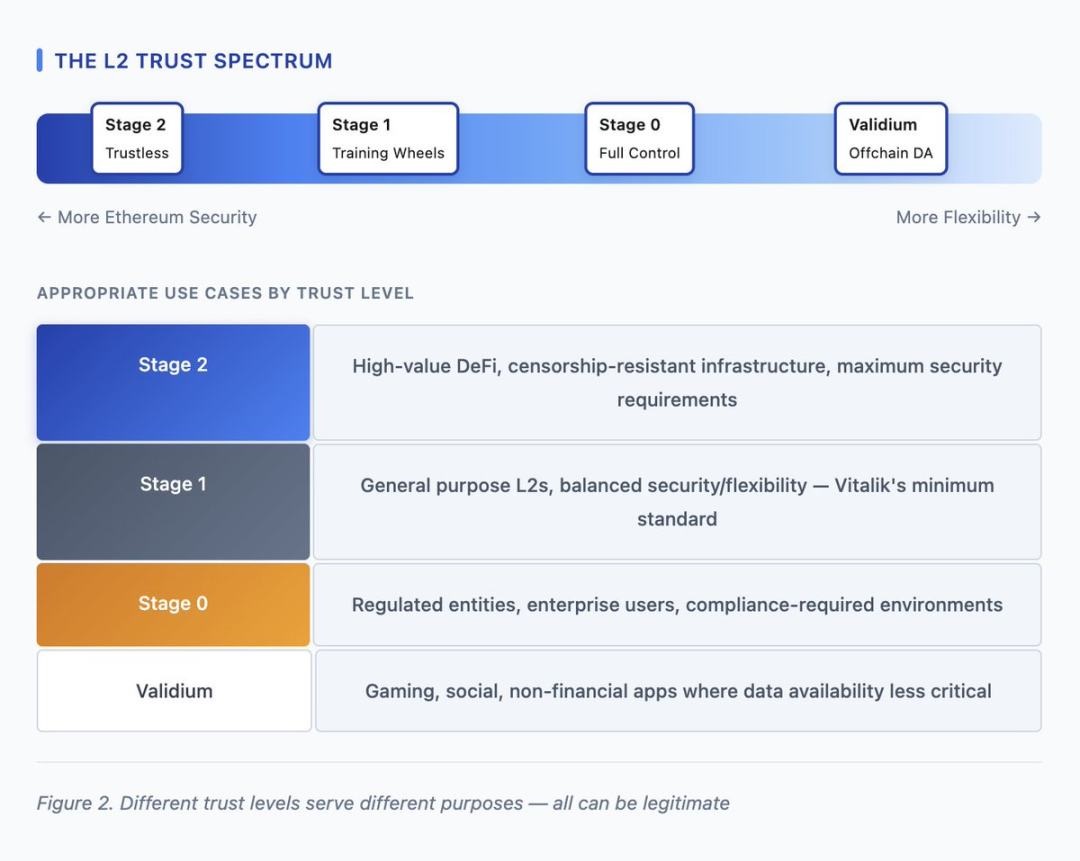

Vitalik’s core theoretical contribution is redefining L2 as existing along a continuous spectrum rather than a single category with uniform obligations. The metaphor of “branded sharding” once implied that all L2s should pursue second-stage decentralization and operate as extensions of Ethereum’s value and security guarantees. The new framework recognizes that different L2s serve different goals; for projects with specific needs, stages 0 or 1 can be entirely reasonable endpoints.

This reconstruction has strategic significance because it eliminates the implicit judgment that “L2s that do not pursue full decentralization are failures.” An institution serving clients requiring asset freezing, or a regulated L2, is not a defective version of Arbitrum but a differentiated product tailored to different markets. By legitimizing this spectrum, Vitalik enables L2s to honestly position themselves without making decentralization promises lacking economic incentives.

Native Rollup pre-compile proposals

The technical core of Vitalik’s article lies in native Rollup pre-compile solutions. Currently, each L2 constructs its own system to prove state transitions to Ethereum: Optimistic Rollup uses fraud proofs with a 7-day challenge period, ZK Rollup relies on validity proofs with custom circuits. Each implementation requires independent auditing, may hide vulnerabilities, and must be upgraded synchronously when Ethereum hard forks change EVM behavior. This fragmentation poses security risks and maintenance burdens for the entire ecosystem.

Native Rollup pre-compiles would be embedded directly into the EVM execution verification functions of Ether. Each Rollup would no longer need to maintain custom proof systems but could simply call this shared infrastructure. This approach offers significant advantages: replacing dozens of independent implementations with a single audited codebase, automatically maintaining compatibility with Ethereum upgrades, and potentially removing the security committee mechanism after practical testing of the pre-compile functions.

Synchronous composability vision

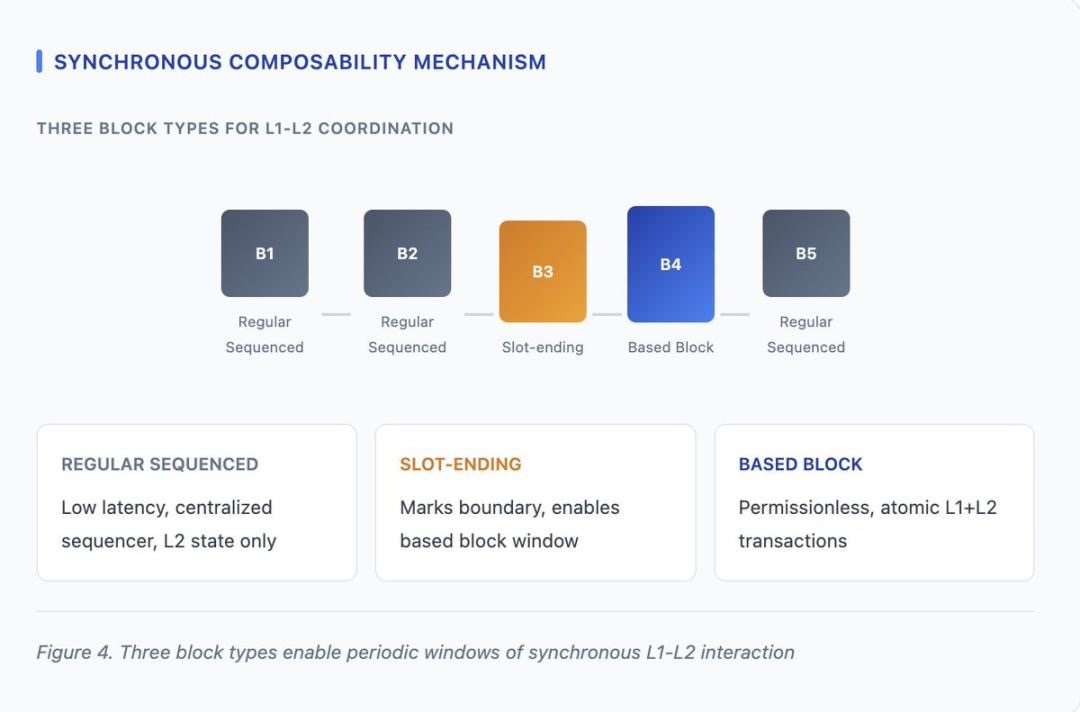

A detailed post on ethresear.ch elaborates on mechanisms to achieve synchronous composability between L1 and L2. Currently, transferring assets or executing logic across L1 and L2 boundaries requires waiting for finality (7 days for optimistic rollups, hours for ZK rollups) or relying on fast cross-chain bridges with counterparty risks. Synchronous composability would allow atomic calls across L1 and L2 states within a single transaction, enabling cross-chain read/write operations with either full success or complete rollback.

The proposal designs three types of blocks: regular ordering blocks for low-latency L2 transactions, boundary blocks marking slot ends, and based blocks that can be built without permission after boundary blocks. During this window, any builder can create blocks interacting with both L1 and L2 states.

Responses from L2 teams

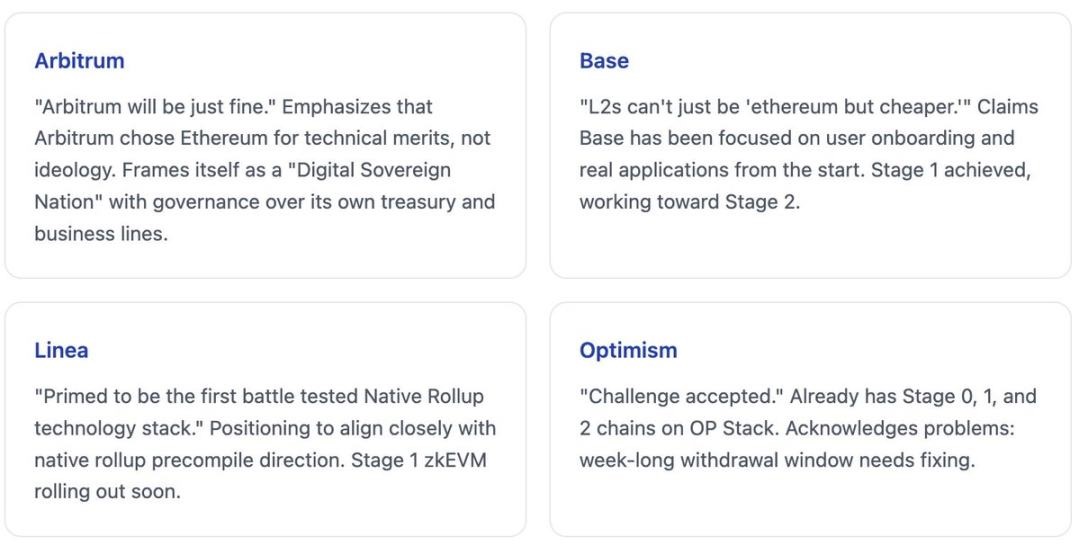

Within hours, major L2 teams responded, demonstrating healthy strategic diversification. This aligns with the trust spectrum framework Vitalik proposed: different teams can pursue differentiated positioning without creating the illusion that “everyone is on the same path.”

Diverse responses reflect a healthy market. Arbitrum emphasizes independence, Base focuses on applications and user experience, Linea closely follows Vitalik’s native Rollup direction, and Optimism openly acknowledges challenges while emphasizing progress. These strategic choices are not about right or wrong but represent differentiated approaches targeting various market segments—legitimacy granted by the trust spectrum framework.

Vitalik’s deep understanding of economic realities

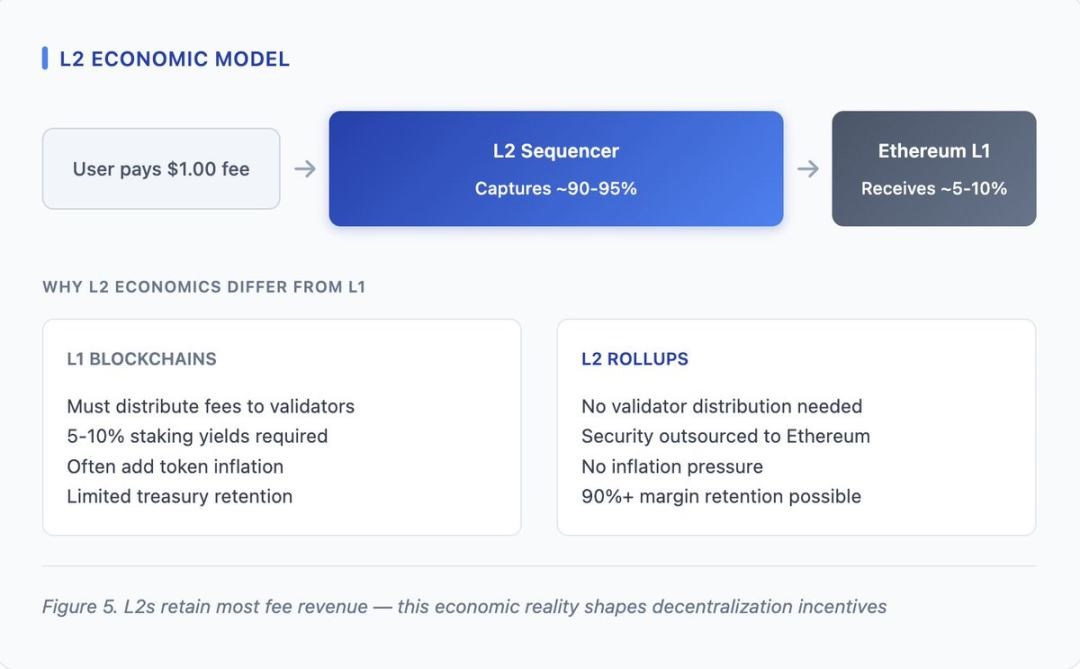

One of the most important insights in Vitalik’s article is the implicit acknowledgment of L2’s economic models. When he points out that some L2s may never surpass stage 1 due to “regulatory requirements” and “ultimate control considerations,” he is recognizing that L2s as commercial entities have legitimate economic interests. These interests differ fundamentally from the idealized “branded sharding” model. Sequencer revenue is a real business need, and regulatory compliance is an unavoidable reality. Expecting L2s to abandon these interests for ideological consistency is inconsistent with commercial logic.

Vitalik’s planned forward path

Vitalik’s discourse is constructive rather than merely diagnostic. He points out specific directions for L2s that want to maintain value amid ongoing L1 scalability. These are not rigid rules but differentiated development suggestions—when “cheaper Ethereum” is no longer a sufficient selling point, L2s can leverage these strategies to build their own advantages.

Conclusion

Vitalik Buterin’s article published in February 2026 marks a strategic recalibration of Ethereum’s L2 approach. Its core insight is that L2 has evolved into an independent platform with reasonable economic incentives, rather than an obligatory “branded sharding” of Ethereum. Vitalik does not oppose this trend but advocates accepting reality by establishing a trust spectrum that recognizes multiple pathways, providing native Rollup infrastructure to enhance L1-L2 integration, and designing cross-layer synchronous composability mechanisms.

The responses from the L2 ecosystem show healthy diversity. Arbitrum emphasizes independence, Base focuses on applications, Linea aligns with the native Rollup direction, and Optimism continues to improve while acknowledging challenges. This diversity is the expected outcome of the trust spectrum framework: different teams can follow different strategies without pretending everyone is on the same road.

For Ethereum, this route correction, based on acknowledging reality rather than defending outdated assumptions, preserves its credibility. With mature ZK-EVM technology, related proposals are feasible. The strategic proposals also create space for healthy ecosystem evolution. This exemplifies adaptive leadership in technology: recognizing environmental changes and proposing new paths forward, rather than stubbornly clinging to old strategies after the market has made its choice.

Having dedicated ten years to scalability research and four years running a Rollup infrastructure company, I have seen too many crypto leaders refuse to adapt when reality diverges from expectations, with poor outcomes. Vitalik’s approach is difficult—publicly admitting that the 2020 vision needs adjustment. But it is the right decision. Clinging to a narrative that no longer aligns with the market is unhelpful for anyone. Today’s path forward is becoming clearer each day, and that alone is of great value.