Introducing the RCM Protocol

XMAQUINA set out to change that. With the RCM Protocol, we go further, outlining the next step in turning a closed market into a liquid, open, and permissionless ecosystem.

Democratizing robotics shouldn’t stop at access. It must become liquid, scalable, and integrated into the broader crypto economy.

RCM is that bridge.

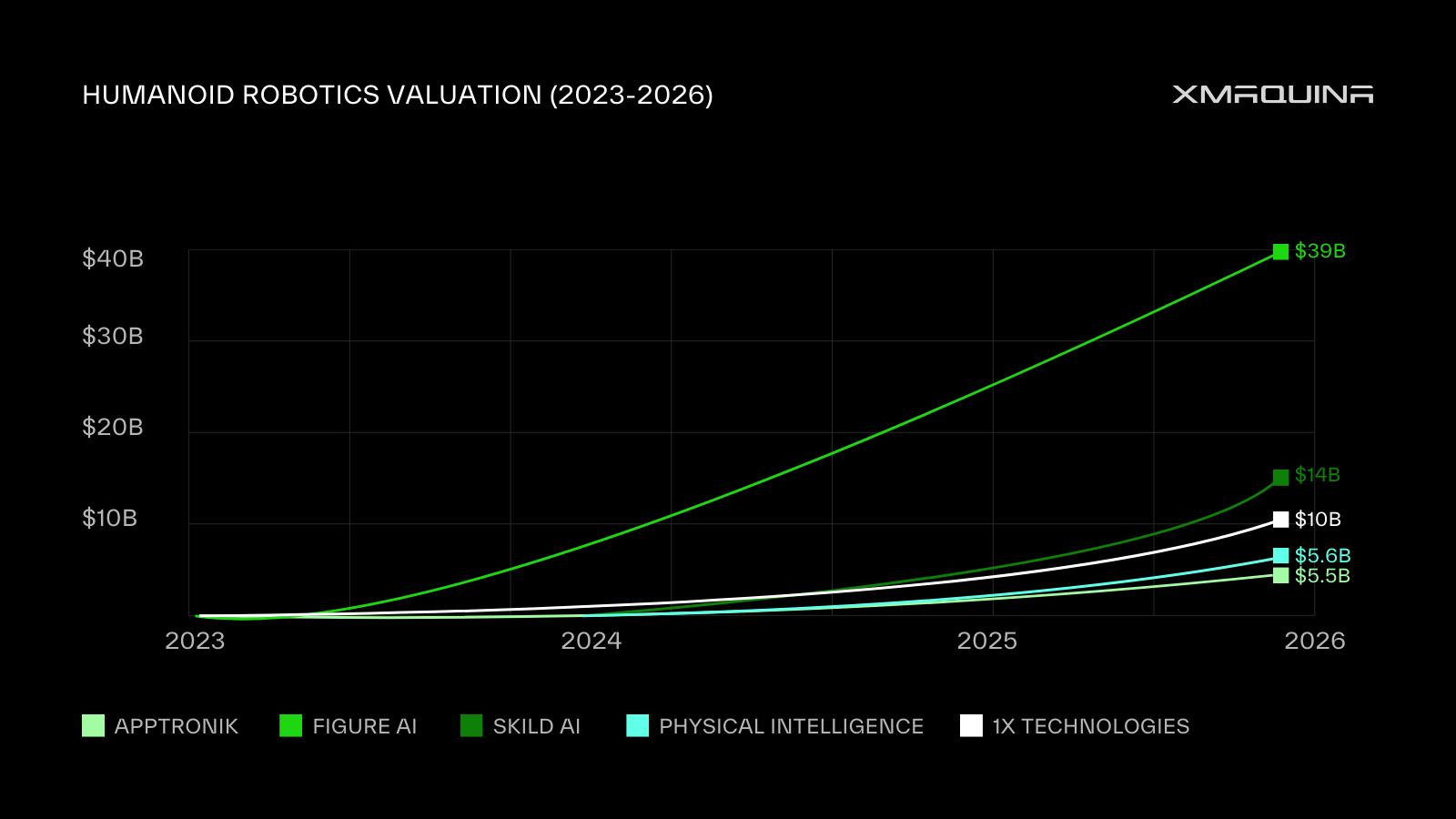

The Humanoid Surge

Humanoid robotics is having its breakout moment.

Valuations have surged, commercialization is underway, and capital is flooding in.

Figure AI grew from a $500M Series A in May 2023 to a $39B Series C by September 2025. Skild AI tripled its valuation in just seven months, reaching $14B by early 2026. Physical Intelligence hit $5.6B in under two years. Meanwhile, 1X Technologies signed a deal to deploy 10,000 humanoids by 2030.

These numbers reflect real traction, not hype. Commercial rollout has already begun. Figure’s units hit the market in early 2025. Skild AI reached $30M in revenue within months of launch.

Yet access remains gated. Retail participants are excluded, secondary markets are fragmented, and allocations flow to a tight circle of institutions.

RCM is designed to break that structure and open the robotics economy to the rest of the world.

Reclaiming the Robotics Capital Markets

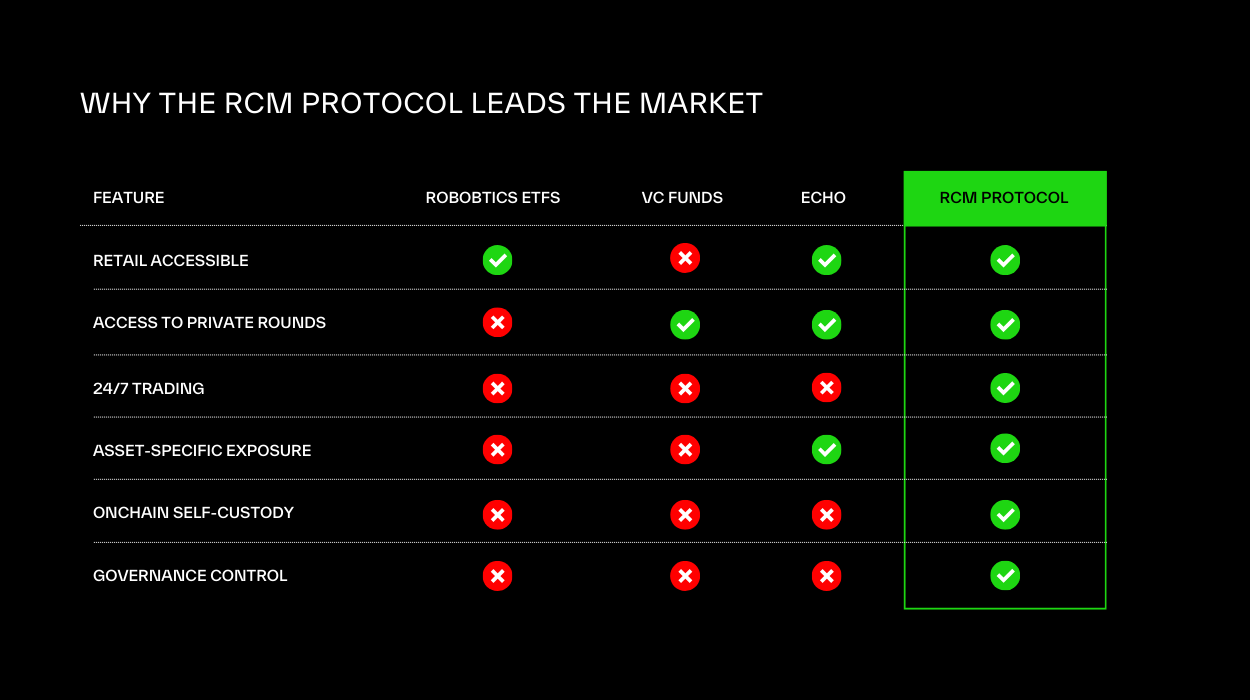

Robotics equity is emerging as one of the most sought-after asset classes, yet remains among the least accessible. Access is restricted by closed funding rounds, high minimum investment thresholds, and accreditation requirements. When secondary trades do occur, they are often fragmented, opaque, and limited to private markets.

The RCM Protocol is designed to change that.

It brings real robotics positions onchain by enabling liquid, permissionless secondary markets. Each SPV, holding verified equity in a robotics company, is represented by an asset specific SubDAO Token. These tokens are designed to be tradable on a DEX, with no minimums, no accreditation requirements, and no intermediaries.

This structure also enables asset specific exposure. Instead of participating in a blended fund, individuals can align with the specific company they believe in, whether it’s general purpose humanoids, automating warehouses, or advancing defense robotics.

Each trade generates fees that flow into the DAO treasury and, through governance, can be directed toward key initiatives.

- Acquiring additional robotics equity

- Executing DEUS buybacks

- Funding DEUS staking incentives

On top of that, each SubDAO Token will be paired against DEUS in a liquidity pool, driving added demand and utility for the DEUS token itself.

The result is a flywheel. More trading means more treasury inflow, more robotics positions, and more value cycling back to DEUS.

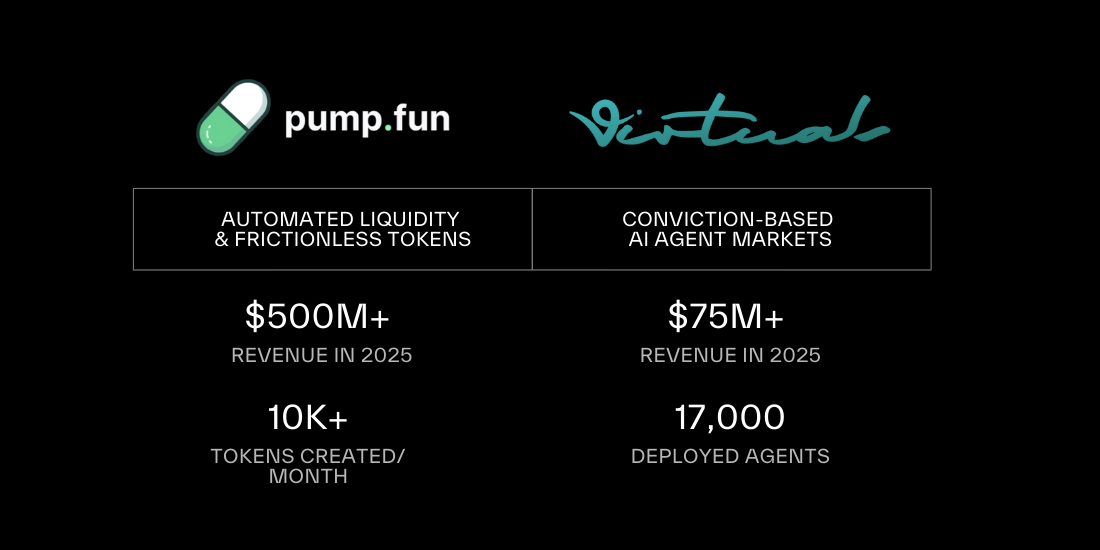

Building on Pump.fun and Virtuals

RCM draws inspiration from two protocols that reshaped onchain value creation.

Pump.fun demonstrated the power of automated liquidity and frictionless token creation. It unlocked massive participation and generated over 500 million dollars in trading volume within its first year.

Virtuals Protocol introduced a new kind of market. One built around attention and belief and tokenized conviction. Markets formed around specific AI agents, enabling communities to express support and speculate on future relevance.

RCM adapts both of these breakthroughs to a new frontier: robotics equity.

But it adds one critical layer. Real-world alignment.

RCM is designed to:

- Automate liquidity provisioning for robotics equity positions

- Enable conviction-driven participation at the individual asset level.

- Anchor tokens to SPVs that hold verified, real-world equity

RCM is not a token framework. It is a capital coordination layer. A new architecture for accessing, pricing, and participating in private robotics markets through onchain infrastructure.

This design sets the stage for a new class of token: one built around belief, but grounded in real exposure.

What Are Robotics SubDAO Tokens?

When a Robotics SubDAO Auction is completed, the capital raised is used to acquire equity in a specific robotics company. That equity is held in a dedicated SPV (special purpose vehicle) created for the position. Once the position is confirmed, a unique SubDAO Token is minted to represent alignment with that specific company.

These tokens do not represent equity or ownership. They carry no rights to shares or dividends. Instead, they allow onchain participants to express conviction and trade sentiment around individual robotics assets.

As regulatory clarity evolves, future mechanisms may deepen the relationship between SubDAO Tokens and the underlying assets.

SubDAO Tokens are:

• Asset specific: each token corresponds to one SPV and one robotics company

• Tradable: designed for continuous liquidity on a DEX

• Anchored: backed by real-world equity positions

They are a new way to coordinate belief, capital, and community around the robotics market.

How It Works

Deal Sourcing

XMAQUINA surfaces allocation opportunities in top robotics companies.Capital Raise

The community and institutions fund the deal through a SubDAO Auction.

If the raise doesn’t meet its minimum, the deal doesn’t proceed.SPV Created

A dedicated SPV is formed to hold the equity once the raise succeeds.Token Minted

A SubDAO Token is issued, tied to the specific SPV and robotics company.DEX Launch

The token is paired with DEUS and becomes tradable on a decentralized exchange.Protocol Revenue

Trading fees flow to the treasury and are governed by DEUS holders.

The RCM protocol turns the DAO from a closed-ended fund model into a revenue-generating, continuously capitalizing organization.

Expanding What’s Possible

The protocol’s structure also opens the door to future integrations with prediction markets and perpetuals. These could enable speculation on company milestones, product launches, and broader sector trends, bringing liquidity and visibility to one of the world’s most opaque markets.

What’s Next: Proposal XMQ-03

XMQ-03 will initiate a weighted DAO vote on how to advance the development and funding of the RCM Protocol. The proposal will present options for financing legal structuring and protocol buildout as XMAQUINA builds the permissionless capital layer for the next trillion-dollar frontier.

Disclosure

All mechanisms, structures, and features described are subject to change based on ongoing technical, legal, and community review. SubDAO Tokens do not represent equity, ownership, or any legal claim on underlying assets. They confer no rights to dividends, governance, or redemption. Any value they accrue is entirely market-driven and may not reflect the valuation or performance of the associated SPVs or companies.

Participation in RCM-related activities may be restricted based on jurisdiction. Readers are encouraged to conduct independent research and consult legal or financial advisors before interacting with the protocol.

Disclaimer:

- This article is reprinted from [xmaquina]. All copyrights belong to the original author [xmaquina]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?