توقع سعر USDP لعام 2025: دراسة اتجاهات السوق والتطلعات المستقبلية لعملة Pax Dollar ضمن منظومة العملات المستقرة العالمية

مقدمة: الموقع السوقي لـUSDP وقيمته الاستثمارية

تعتبر Paxos (USDP) أول عملة مستقرة منظمة عالميًا، وقد حققت منذ انطلاقها في عام 2018 إنجازات بارزة. بحلول عام 2025، بلغ رأس المال السوقي لـUSDP نحو 63,245,588 دولارًا، مع معروض متداول يقارب 63,264,568 رمزًا، وسعر مستقر حول 0.9997 دولار. هذا الأصل الذي يُعد بديلاً رقمياً للنقد، يضطلع بدور محوري متزايد في توفير السيولة لتداول العملات الرقمية وتسوية المعاملات الفورية عبر مختلف فئات الأصول.

يستعرض هذا المقال بشكل شامل اتجاهات سعر USDP للفترة 2025 – 2030، مع تحليل الأنماط التاريخية والعرض والطلب وتطور النظام البيئي والعوامل الاقتصادية الكلية، لتقديم توقعات سعرية احترافية واستراتيجيات استثمار عملية للمستثمرين.

I. استعراض تاريخ سعر USDP والوضع السوقي الراهن

تطور سعر USDP عبر التاريخ

- 2018: إطلاق USDP باسم Paxos Standard (PAX) بسعر أولي 1 دولار

- 2021: إعادة تسمية PAX إلى USDP مع الحفاظ على تثبيت 1 دولار

- 2024: بلغ أعلى سعر 1.502 دولار في 16 أبريل، وأدنى سعر 0.9824 دولار في 3 يناير

الوضع السوقي الحالي لـUSDP

بتاريخ 29 سبتمبر 2025، يجري تداول USDP عند 0.9997 دولار، بحجم تداول يومي يبلغ 617,330.87 دولار. أظهر الرمز تقلبات طفيفة مع ارتفاع 0.03% في آخر 24 ساعة. يبلغ رأس المال السوقي 63,245,588.90 دولار، ويحتل المرتبة 605 بين العملات الرقمية. يتطابق المعروض المتداول مع المعروض الكلي عند 63,264,568.27 USDP دون وجود حد أقصى للمعروض. يحافظ USDP على مكانته كعملة مستقرة تتابع قيمة الدولار الأمريكي بدقة.

انقر لعرض السعر السوقي الحالي لـUSDP

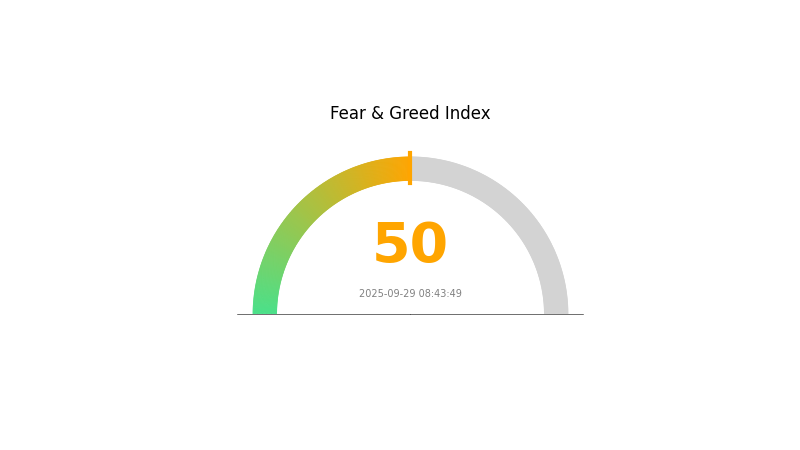

مؤشر معنويات سوق USDP

29-09-2025 مؤشر الخوف والطمع: 50 (محايد)

انقر لعرض مؤشر الخوف والطمع الحالي

تشير المعطيات إلى أن معنويات سوق العملات الرقمية اليوم متوازنة. يستقر مؤشر الخوف والطمع عند 50، ما يعكس حيادية المستثمرين تجاه آفاق USDP دون ميل مفرط للتشاؤم أو التفاؤل. في ظل غياب اتجاه قوي، تظهر فرص لكل من المشترين والبائعين. على المتداولين التحلي باليقظة وتطبيق استراتيجيات إدارة مخاطر مناسبة في هذا السياق المتوازن. ينبغي اتخاذ القرارات الاستثمارية بناءً على دراسة وتحليل معمقين.

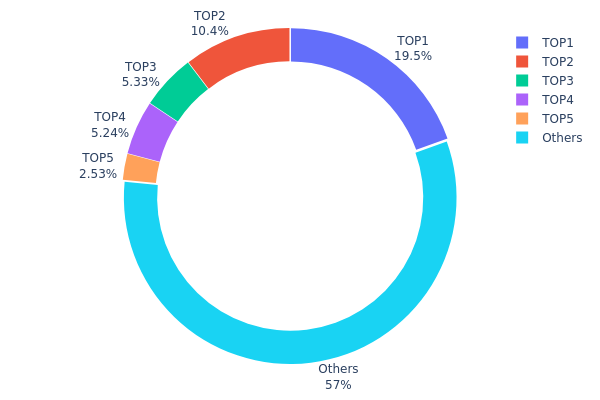

توزيع ملكية رموز USDP

تُظهر بيانات توزيع الملكية تركّزًا ملحوظًا في سوق USDP؛ إذ تسيطر أعلى خمسة عناوين على 42.96% من إجمالي المعروض، وتبلغ حصة أكبر حامل 19.51%. يثير هذا التركيز مخاوف حول احتمالات التلاعب وتقلب الأسعار.

رغم توزيع 57.04% من USDP بين عناوين أخرى، إلا أن هيمنة بعض الحائزين الكبار تشير إلى هيكل مركزي نسبيًا، ما يمنحهم تأثيرًا كبيرًا على ديناميكيات السوق وتحركات الأسعار عبر أوامر بيع أو شراء ضخمة. كما أن القرارات أو التحركات الصادرة عن هؤلاء الحائزين قد تؤثر بشكل بالغ على استقرار النظام البيئي لـUSDP.

من منظور هيكل السوق، يشير هذا التوزيع إلى مستوى متوسط من المركزية، وهو ما قد يثير قلق المستثمرين الساعين لخيارات أكثر لامركزية. تعكس بيانات التوزيع الحالية أن استقرار USDP على السلسلة عُرضة لتأثيرات فئة محدودة من كبار الحائزين.

انقر لعرض توزيع ملكية USDP الحالي

| الأعلى | العنوان | كمية الملكية | الملكية (%) |

|---|---|---|---|

| 1 | 0xf840...61ab62 | 11953.17K | 19.51% |

| 2 | 0x091d...2fb90c | 6353.80K | 10.37% |

| 3 | 0xf845...2aabb7 | 3263.99K | 5.32% |

| 4 | 0x28c6...f21d60 | 3208.12K | 5.23% |

| 5 | 0x35a0...2661a4 | 1551.97K | 2.53% |

| - | أخرى | 34921.48K | 57.04% |

II. العوامل الجوهرية المؤثرة على سعر USDP المستقبلي

آلية العرض

- إدارة الاحتياطي: قدرة Paxos على دعم USDP باحتياطيات كافية تعد أساسية لاستقرار العملة وقيمتها.

- الأثر الحالي: يعتمد استقرار USDP وثقة السوق به مباشرة على كفاءة إدارة احتياطيات Paxos.

ديناميكيات المؤسسات والمستثمرون الكبار

- الرقابة التنظيمية: قد تؤدي زيادة الإشراف التنظيمي على العملات المستقرة، بما في ذلك USDP، إلى تأثير كبير على مستويات التبني والاستقرار السعري.

البيئة الاقتصادية الكلية

- خصائص التحوط من التضخم: أداء USDP كعملة مستقرة مرتبطة بالدولار الأمريكي يعتمد بشكل وثيق على قوة الدولار في أوقات التضخم.

التطور التقني وتطبيقات منظومة العملات الرقمية

- الطلب السوقي: يؤثر الطلب الكلي على العملات المستقرة داخل منظومة العملات الرقمية بصورة جوهرية على تبني USDP واستقراره السعري.

- تطبيقات منظومة العملات الرقمية: دمج USDP في منصات DeFi المختلفة واستخدامه في المعاملات العابرة للحدود يعزز فائدته ويزيد الطلب عليه.

III. توقعات سعر USDP للفترة 2025 – 2030

توقعات عام 2025

- توقع متحفظ: 0.99 – 1.00 دولار

- توقع محايد: 1.00 دولار

- توقع متفائل: 1.00 – 1.01 دولار (مشروط بزيادة التبني واستقرار السوق)

توقعات 2027-2028

- مرحلة السوق: نمو مستقر واعتماد أوسع

- نطاق السعر المتوقع:

- 2027: 0.99 – 1.01 دولار

- 2028: 0.99 – 1.01 دولار

- العوامل المحفزة: توسع الاستخدام في DeFi، وزيادة وضوح التنظيمات

توقعات المدى البعيد 2029-2030

- سيناريو أساسي: 0.99 – 1.01 دولار (مع استمرار استقرار السوق)

- سيناريو متفائل: 1.00 – 1.02 دولار (في حالة التبني الواسع ماليًا عالميًا)

- سيناريو تحولي: 1.00 – 1.03 دولار (في حال أصبح USDP من العملات المستقرة الرائدة)

- 31-12-2030: USDP 1.01 دولار (مع احتمال علاوة طفيفة نتيجة الطلب المرتفع)

| السنة | أعلى سعر متوقع | متوسط السعر المتوقع | أدنى سعر متوقع | نسبة التغير |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. استراتيجيات الاستثمار الاحترافية وإدارة المخاطر لـUSDP

منهجية الاستثمار في USDP

(1) استراتيجية الاحتفاظ طويل الأمد

- للمستثمرين المحافظين الباحثين عن الاستقرار

- نصائح تطبيقية:

- تخصيص نسبة صغيرة من المحفظة لـUSDP كأصل مستقر

- مراقبة التحديثات التنظيمية والوضع المالي للمُصدر

- تخزين USDP في محفظة أجهزة آمنة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة: لمتابعة الاتجاهات السعرية القصيرة

- حجم التداول: لرصد الحركات السوقية المحتملة

- نصائح للتداول المتأرجح:

- تعيين أوامر وقف خسارة محكمة لتقليل المخاطر

- استغلال فرص المراجحة بين المنصات المختلفة

إطار إدارة المخاطر لـUSDP

(1) مبادئ توزيع الأصول

- المستثمرون المحافظون: 5-10% من محفظة العملات الرقمية

- المعتدلون: 10-20% من المحفظة الرقمية

- ذوو المخاطرة العالية: 20-30% من المحفظة الرقمية

(2) حلول التحوط

- تنويع الاستثمارات عبر عدة عملات مستقرة

- إجراء مراجعات دورية لمتابعة دعم واحتياطات USDP

(3) حلول الحفظ الآمن

- توصية بمحفظة أجهزة: محفظة web3 من Gate

- الحفظ البارد: استخدام المحافظ غير المتصلة بالإنترنت لتخزين طويل الأمد، مثل المحفظة الورقية أو الأجهزة المادية

- إجراءات الأمان: تفعيل المصادقة الثنائية واستخدام كلمات مرور قوية

V. المخاطر والتحديات المحتملة أمام USDP

مخاطر السوق لـUSDP

- مخاطر السيولة: صعوبات محتملة في عمليات الاسترداد واسعة النطاق

- المنافسة: تصاعد المنافسة من عملات مستقرة أخرى

- تقلبات ناتجة عن مناخ سوق العملات الرقمية

المخاطر التنظيمية لـUSDP

- تغييرات محتملة في أنظمة العملات المستقرة

- تشديد إجراءات KYC/AML

- إجراءات قانونية محتملة ضد مصدري العملات المستقرة

المخاطر التقنية لـUSDP

- ثغرات العقود الذكية واستغلالها

- ازدحام الشبكة وتأخر المعاملات

- مشكلات التوافق مع بروتوكولات DeFi الحديثة

VI. الخلاصة والتوصيات

تقييم قيمة USDP الاستثمارية

يقدم USDP استقرارًا في سوق العملات الرقمية المتقلبة، لكنه يواجه تحديات تنظيمية ومنافسة متنامية من عملات مستقرة أخرى. تكمن قوته طويلة الأمد في الامتثال التنظيمي والدعم المؤسسي.

توصيات الاستثمار في USDP

✅ للمبتدئين: ضع USDP كجزء صغير ومستقر في محفظتك الرقمية ✅ للمستثمرين المحترفين: استخدم USDP للتداول قصير الأجل وكأداة تحوط ✅ للمؤسسات: قيّم USDP لإدارة الخزينة والتعرض المنخفض المخاطر لسوق العملات الرقمية

طرق التداول والمشاركة في USDP

- تداول فوري: شراء وبيع USDP عبر Gate.com

- بروتوكولات DeFi: استخدام USDP في تطبيقات التمويل اللامركزي

- تداول OTC: صفقات كبيرة من خلال مكتب OTC في Gate.com

الاستثمار في العملات الرقمية يحمل مخاطر مرتفعة للغاية، وهذه المادة لا تُعد نصيحة استثمارية. يجب أن يتخذ المستثمرون قراراتهم بناءً على تحملهم للمخاطر، ويُنصح باستشارة خبراء ماليين مختصين. لا تستثمر أبدًا أكثر مما يمكنك تحمّل خسارته.

الأسئلة الشائعة

هل USDP عملة مستقرة؟

نعم، USDP عملة مستقرة، مرتبطة بالدولار الأمريكي ومصممة للحفاظ على قيمة 1 دولار. تعمل USDP عبر شبكة Ethereum.

كم تبلغ قيمة USD Coin عام 2030؟

من المتوقع أن يحافظ USD Coin (USDC) على تثبيته مقابل الدولار بنسبة 1:1 في عام 2030 كعملة مستقرة، وستظل قيمته عند 1 دولار ما لم تطرأ تغييرات جوهرية على بنيته أو أصوله الاحتياطية. يختلف USDC عن USDP في نوع الأصول التي تدعمه.

كم يساوي 1 USDP؟

في 29-09-2025، تبلغ قيمة 1 USDP نحو 0.9999 دولار أمريكي، ويحافظ على سعر قريب جدًا من دولار واحد.

ما الفرق بين USDP وUSDC؟

USDP وUSDC كلاهما عملات مستقرة. USDC مدعومة بالنقد والأصول السائلة، بينما USDP مدعومة بمزيج من الأصول كما هو الحال مع USDT. يختلف مصدر كل منهما؛ فـUSDP تصدرها Paxos وUSDC تصدرها شركة أخرى.

توقعات سعر USD1 لعام 2025: تحليل مفصل وتنبؤ بأبرز العوامل السوقية المؤثرة في أسعار العملات الرقمية

فالكُن فِينانس (FF): ما هو وكيف يعمل

عملة USD1: ما هي وكيف تعمل

توقع سعر CRVUSD لعام 2025: نظرة مستقبلية والعوامل الأساسية التي تؤثر في سوق العملة المستقرة Curve

توقعات سعر B لعام 2025: تحليل اتجاهات السوق والعوامل الأساسية التي تؤثر في تقييمات المستقبل

GUSD: أداة موثوقة لإدارة أصول العملات المستقرة في سوق العملات الرقمية.

فهم منصات إطلاق التوكن: دليل المبتدئين للتعامل مع Crypto Launchpads

توقع سعر SCR لعام 2025: تحليل الخبراء وتوقعات السوق للعام المقبل